Fraud has become commonplace with charity organizations. This has some how has tainted the image of many non-profits. Consequently, donors are reluctant to fund charities without scrutinizing their finances. At least not until they go through audited financial statements. Getting audited has proven to be a stressful time for any non-profit. I sweat at the thought of all those tedious audit questions.

Auditors are seen as bitter watchdogs out there to find something wrong with charity finances. This should not be the case, as auditors assist in identifying financial risks associated with your organization. They also provide recommendations on how to make your financial processes more efficient.

According to SBN Online, the most important thing you should do before the auditor arrives is to close all your books. If you haven’t completed this fundamental task, you can expect the audit questions and processes to take longer. This will allow the CFO to review the financial statements regularly and ensure that the figures are a true reflection of your financial position.

Three tips you can do this.

Make sure all documents are ready

According to Council of Nonprofits, the most important preparation for all the audit questions is making sure all accounting records are up-to-date.

During the audit, expect questions about your financial transactions. So, all financial documents should be easily accessible.

It’s important for your NGO to instill a culture of efficient record keeping. All staff members should make sure that they pull their weight in filing documents.

Pre-audit meeting

It’s crucial for charity staff to know what to expect during the auditing process. Auditors will need staff to help locate and verify information. It’s also important to know in advance when the auditing will take place and for how long.

Most auditing firms send a document outlining the auditing process in detail. It’s important that everyone involved in auditing familiarize themselves with this document.

Soraya Joonas, CFO of Inyathelo (an NGO), shared some of her insights on preparing for a non-profit audit. Joonas insisted on the importance of discussing the presentation of accounts so that the NGO is comfortable with the presentation being true and fair.

Tweet this: Although it’s not the prime role of the audit to detect fraud, it may come to light.

Strengthen your internal control measures

Although it’s not the prime role of the audit to detect fraud, it may come to light. Usually, fraud prevails where internal control measures are weak.

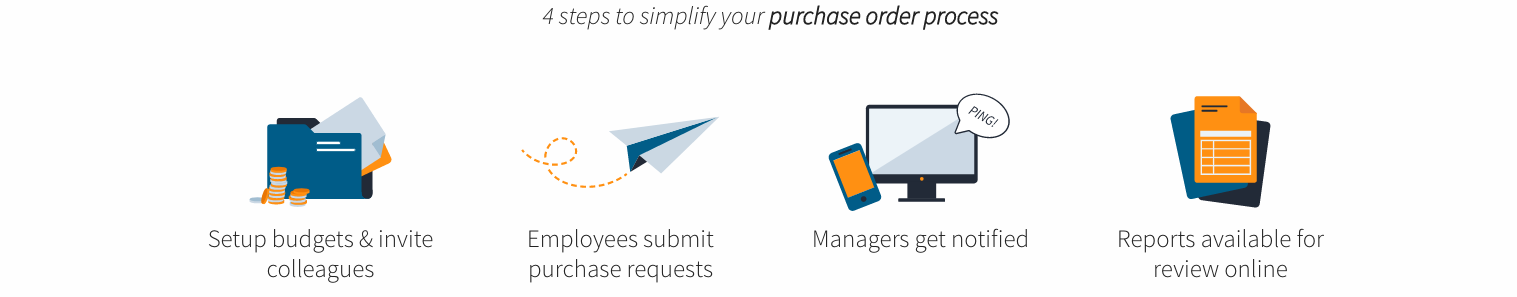

During the auditing process, the auditor may assess the strength of internal control measures implemented by your nonprofit. Furthermore, auditors would assess how you approve purchases.

The auditor may ask questions about the organization’s internal control mechanisms used in reducing possible fraud. The more reliable the system is, the easier it is for the auditor to complete his task with confidence.

Here’s an example that can illustrate this point well: The auditor may provide a list of purchasing transactions to be tested and may request that;

- the nonprofit provides a report on purchasing requests,

- provides a delivery report,

- and must be able to show how POs are approved by management.

The above may only be realized when using PO software that can streamline your purchasing processes and protect your budget from wasted spend.

If you’d like more info about Procurementexpress.com, please contact us: [email protected]

Leave a comment.