A survey conducted by Ernst and Young shows that fraud poses a serious risk to the growth of your business. Unfortunately, most business owners only realize this when it’s too late. They believe that implementing fraud prevention measures such as conducting thorough background checks on new employees, checks and balances on payments to vendors or even rotating duties of employees in procurement, etc, would be enough to prevent fraud. But alas, they’re always proven wrong.

A survey conducted by Ernst and Young shows that fraud poses a serious risk to the growth of your business. Unfortunately, most business owners only realize this when it’s too late. They believe that implementing fraud prevention measures such as conducting thorough background checks on new employees, checks and balances on payments to vendors or even rotating duties of employees in procurement, etc, would be enough to prevent fraud. But alas, they’re always proven wrong.

There are different circumstances that expose companies to fraud. For instance, when one employee performs multiple accounting functions and becomes too familiar with the company’s finances. Such circumstances make defrauding your business ‘too easy’ for criminals or employees.

Let’s explore the following ways that fraudsters use to defraud companies.

Tweet this: There are different circumstances that expose companies to fraud.

1.False invoicing

This type of fraud is commonly known as fraud invoice. According to Deloitte, invoices that do not appear to have been generated through a computerised accounting system, flags potential for invoice fraud. In New Zealand for instance, fraud invoice is regarded as one of the most common crimes that cost businesses millions.

This type of fraud is commonly known as fraud invoice. According to Deloitte, invoices that do not appear to have been generated through a computerised accounting system, flags potential for invoice fraud. In New Zealand for instance, fraud invoice is regarded as one of the most common crimes that cost businesses millions.

Fraudsters will pose as suppliers and ask companies to update bank details on an outstanding invoice. They can do this easily because they not only know which suppliers companies use but also when payments are due to said suppliers. Every company is vulnerable to invoice fraud, but a company that still uses paper-based purchase orders is even more at risk.

Examples

- In New Zealand, Jimmy Ming Miu, an IT Manager defrauded his employer, McKay Shipping, more than $1 million over a 6 year period. Miu raised false invoices for IT equipment from Avanti Systems and Avanti Systems Integration, companies that he had control of. His employer didn’t see a reason to implement strict approval routines for purchase orders. Moreover, the purchase order system used didn’t allow his employer to monitor purchase orders in real time.

- Hemant Kumar Maharaj and Suresh Din, defrauded the former North Shore City (New Zealand) council of more than $829,000 over 10 years. Maharaj was employed by the council and he arranged for Din to submit invoices to him for payment for road and berm (a flat strip of land) maintenance that was never completed. The Council paid the invoices into a bank account controlled by Din, who split the stolen money with Maharaj.

Solution: The best way to prevent fraud invoice is by simply monitoring all payments, purchase orders, deliveries and received payments. Something that would be a tad difficult when using paper-based systems.

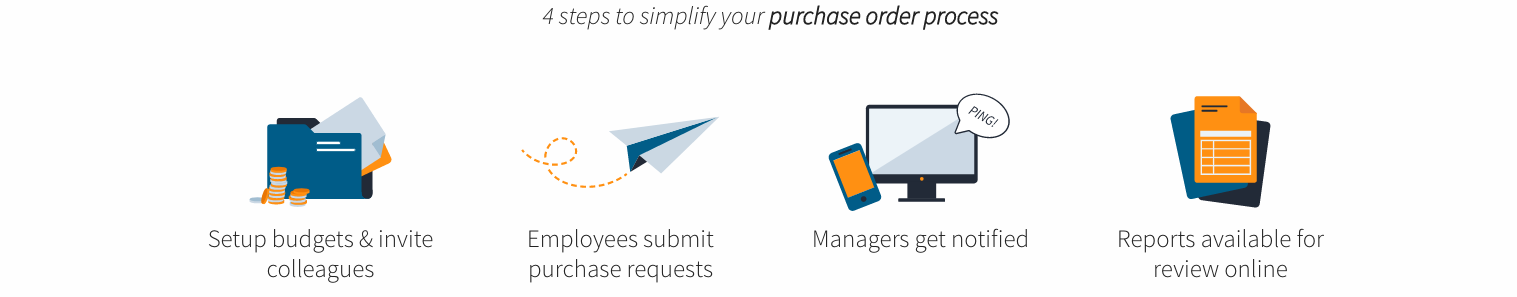

Your company should use a software that typically alerts you every time a purchase or payment is about to be made. For example, a purchase order software such as Procurementexpress.com does this amazingly by alerting you every time an employee submits a PO. You and your executive(s) can approve or reject PO requests before they are sent to a supplier.

2.Overpayment scam

In this case, a scammer can show interest in the products or services that your business offers. Then, subsequently, suggests paying your business using a check that exceeds the amount charged on the invoice. He/she will request that you pay back the difference because an overpayment was made. You’ll only realize that you’ve been fleeced when you try to cash the check!

Solution: Avoid accepting check payments from new customers. Doing this will save you time and money.

3.The fake CEO

Let’s say you are in a jubilant mood because your meeting to secure funding for your new project was successful. Upon returning to your office you find out that there’s a huge amount of money that has been paid to an unknown supplier at your instruction, by email. You know nothing about this particular payment because this email was not sent by you!

This happened to Carol Gratzmullers, CEO of a medium-sized French company called Etna Industrie. Carol’s company has been manufacturing industrial equipment for nearly 75 years. Her workers fell for a spoofed email which instructed the finance department to transfer money to a certain account. The fraudster used software which manipulated the characteristics of Carol’s email so that it looked genuine.

Solution: First and foremost, make sure that your employees are aware of all kinds of fraud. Also, consider using a two-way authentication access to your email. Note that this won’t be as helpful when fraudsters decide to spoof your email address.

Another way of preventing email scams is to consider having policies and procedures for handling emails that request employees to wire transfers. For example, the email recipient should always pick up the phone to verify the request directly with the email sender before processing payments.

4.Employee fraud

When your company does not use a system that allows you to monitor your finances, employees might use that as an opportunity to steal money. They can do this through payroll fraud, embezzlement, diversion of funds, vendor fraud, etc.

When your company does not use a system that allows you to monitor your finances, employees might use that as an opportunity to steal money. They can do this through payroll fraud, embezzlement, diversion of funds, vendor fraud, etc.

Most employees find vendor fraud as the easy way to steal company’s money. Your trusted employee, for instance, can assist a corrupt vendor to overcharge your company, and you might end up paying for goods that were never delivered!

Solution: Fraudulent vendors do not choose. They target small and medium-sized because they’ve noticed that they:

- Have no formal procedure of processing payments or that;

- The company is not using an automated purchase order software

It can be hard to detect such fraud when your company uses paper-based purchase orders. An automated purchase order software such as Procurementexpress.com helps CEOs to have an upper hand by alerting them every time a purchase requisition is sent. Business leaders can approve or reject purchase orders anytime or anywhere. What’s more interesting is that busy CEOs like you would be able to access purchase order reports whenever a need to verify arises.

Sign up for a free trial today! Procurementexpress.com’s team is available 24/7 just to make sure you’re not the next victim of fraud.

Get rid of the paper-trail hassle with inclusive online reporting that eliminates fraud.