Failure to budget efficiently does not mean your business idea is not working. It could just be a sign that you need to equip yourself with the right budgeting tools.

Failure to budget efficiently does not mean your business idea is not working. It could just be a sign that you need to equip yourself with the right budgeting tools.

Please keep reading only if:

- You had a great sales month but, to your dismay, have no money in the bank.

- Your business is growing fast but there is never enough left over to give yourself that raise you so richly deserve.

Or my favorite:

- Opening your management accounts feels like scratching off a scratch card – you never know what you are going to get.

If you are still here, you are not alone. In fact, three out of four businesses that go to the wall this year will do so because they experienced some variation of the above but ignored the warning signs. Poorly managed cashflow kills, or as my wife is fond of saying, “Turnover is vanity, profit is sanity.” Yes, she really says that. We both need to get out more…

Now, to be honest, budgeting can be quite frustrating. The slings and arrows of outrageous fortune or gut-wrenching loss will mess with your carefully orchestrated spreadsheet. However, successful budgeting involves knowing when to stand firm and when to give way. As Dwight Eisenhower said, “planning is everything, the plan is nothing”. Revising and adapting your budgets frequently will help keep you in touch with reality.

Tweet this:The slings and arrows of outrageous fortune or gut-wrenching loss will mess with your carefully orchestrated spreadsheet

Just remember, if you need to adapt your budgets, don’t take it personally. A fledgling business like mine, for instance, takes into account the economic, organizational and other variables that are not within the company’s control. We understand that in business, it’s important to account for both fixed unexpected costs.

First, let’s get started with what you already know:

- Budgeting will save you from going down in flames some day.

- Without an efficient budgeting method, it’s difficult to manage your finances.

- Your budget evolves along with your business.

The main purpose of budgeting is to ensure that your business spend stays within preset limits. It also aids in anticipating the unexpected. However, I’m sure you know that it is virtually impossible to account every single variable or stay within every planned limit. The CEO of IDU (an accounting software company), Kevin Phillips, says: When you ask your accountant why he has gone 50% over budget for a particular month, you’re likely to get one of the two following answers:

The main purpose of budgeting is to ensure that your business spend stays within preset limits. It also aids in anticipating the unexpected. However, I’m sure you know that it is virtually impossible to account every single variable or stay within every planned limit. The CEO of IDU (an accounting software company), Kevin Phillips, says: When you ask your accountant why he has gone 50% over budget for a particular month, you’re likely to get one of the two following answers:

- “Oh, I didn’t know let me go back and relook.”; or

- “I don’t know, how am I supposed to know? I am an accountant, I only punch numbers.”

These answers are a reminder that the buck stops with you as the business owner. Without further ado, I present to you the Top Down Approach and the Bottom Up Approach.

Top Down Budgeting:

In this approach, you take last year’s P+L, add 5% to each line item and call it a budget.

Some, slightly, more nuanced version of this is how most companies do it. It keeps you on an even keel and you then dish out the budgets to your loyal lieutenants, bestowing each the promise of autonomy and the threat of obliteration if they mess up. Or, is the obliteration thing just my style?

If you are tight on administrative funds, or if you are just frugal in general, this is the best bang for your buck.

Pros:

- You are in control

- It is easy to evaluate

- Only one budget is created

Cons:

- It is difficult to change even if it’s not working

- The implementation cost is likely to be higher.

Bottom Up Budgeting:

With this approach, you have more time to go through each P+L line item and build up what you need from first principles. Put the “big rocks” in first — list salaries and rent, then slowly get quotes and estimates for other expenses as you go.

Your top lieutenants will help you along the way here and it is a great way to get buy-in from the entire team on how the business is run, giving them ownership of their particular line of items.

Pros:

- More buy-in from your team

- Can drive you towards business objectives

Cons:

- More time consuming as every department creates its own budget

- Staff are not incentivized to come up with small estimates

- Senior managers can set targets that are easy to achieve

In general, budgeting puts a firewall around your business. It empowers your team and will give you a greater sense of calm that you didn’t think came with the territory of being successful. Choosing between the two approaches above should be tailored to your business, how it functions, and the specific goals you set for that particular year.

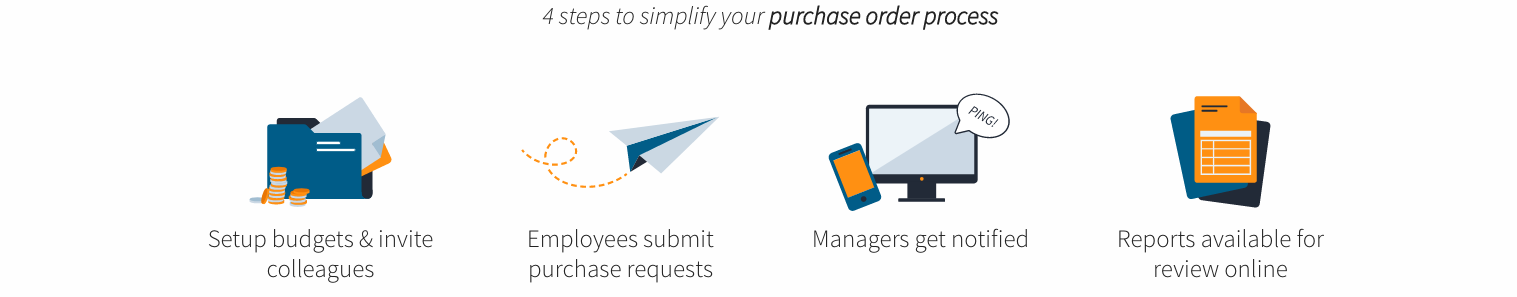

Implementing your budget is the next step. Take your freshly minted Top Down or Bottom Up budget, pour it into an efficient software, divvy up the responsibility, and never fear to open your bank accounts again.

Reach out to me and I’ll show you how.

Get rid of the paper-trail hassle with inclusive online reporting that eliminates fraud.