Having no approval routing in your company increases opportunities for overspending. For instance, when your company uses only Excel spreadsheets, it’s hard to set up approval routing, which means you can’t spend within budget.

Having no approval routing in your company increases opportunities for overspending. For instance, when your company uses only Excel spreadsheets, it’s hard to set up approval routing, which means you can’t spend within budget.

This is what may happen when your company doesn’t have any approval routing in place:

Example

Meet Michelle. She is a producer at a medium-sized video marketing company which uses only Excel spreadsheets to process purchase orders. Four days ago, her boss, Rufus, traveled overseas to attend a leader’s conference. She’s been waiting for him to approve her purchase requisition for a $2500 HD video camera for two days now.

As a result, Michelle’s patience is running thin. If she doesn’t get the video camera by tomorrow, she won’t be able to shoot the commercial video. Which means, she won’t meet the deadline. She has tried sending the requisition to her boss via email. Yet, there’s been no response from him.

Tweet this: Having no approval routings in your company increases opportunities for overspending.

She can’t go ahead and send a purchase order without Rufus approving it. Rufus expects everyone to adhere to the strict approval policies. Does having strict approval policies alone help?

Why having strict approval policies is not enough

Approval policies are only a guideline that employees like Michelle are required to comply with. And having such policies alone doesn’t guarantee compliance. In Michelle’s case, she can either comply with them or decide to put them aside and create a purchase order without her boss’s approval.

The pros

- Approval policies serve only as a guideline to creating purchase orders.

- Each approval policy has a priority on the backend. For example, an employee can send requests in accordance with their request level.

- Approval policies can be updated to fit in with the company’s strategic decisions.

The cons

- Approval policies on their own cannot deter exceeding budget.

- Having approval policies does not necessarily deter fraud.

Approval routing

As previously mentioned, having tight purchasing policies is not enough to prevent overspending. Your company would need to set up approval routings which will set a limit on how much each authorized approver can approve.

As previously mentioned, having tight purchasing policies is not enough to prevent overspending. Your company would need to set up approval routings which will set a limit on how much each authorized approver can approve.

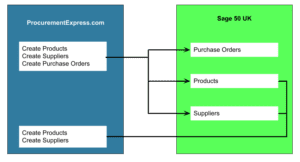

You’ll need a software like Procurementexpress.com which enables frustrated employees like Michelle to get quick approvals. Furthermore, it’ll allow your company to streamline purchases effectively.

You’d implement approval routings guided by the following questions:

- Apart from you, who else has the authority to purchase? What can they buy and at what price?

- What criteria do you use to select vendors — quality, shipping times/costs, etc?

- How many quotes do you solicit before selecting a supplier?

- Do you enter into formal supplier contract arrangements? What are the acceptable terms?

- Based on your business needs, how many different suppliers are necessary?

One way companies can make sure employees spend within budget, is by implementing approval routings through a PO system like Procurementexpress.com. With Procurementexpress.com, Michelle would be able to send a purchase order request to Rufus. While he’s away, Rufus would get a notification on his cell phone, check the purchase order requisition and approve or reject it with the click of a button.

This way Michelle and her team wouldn’t have to postpone the shooting because she hasn’t heard back from Rufus. If her request is approved, they can quickly hire a camera and start shooting as soon as they get it. Their animation team would have enough time to work on the videos and their client would be happy to contact their company in the future.

Want to implement approval routings in your company? Sign up for a free trial today!