How SMEs can Lose Money by not enforcing credit terms.

I recently spoke to a small business owner friend about implementing an online purchase order system at Procurementexpress.com. Her business, selling jam, is too small to use such a system, but she spoke to me about a concern that gives her sleepless nights.

Jane runs a small jam company in South Africa. Being a creative entrepreneur, she doesn’t have much time to improve her bookkeeping skills. She explained to me how it seems that she loses money whenever she gives a customer credit. While the business should be running with a good profit margin, she still feels that debtors have a serious affect to her burgeoning debt. Jane couldn’t explain to me exactly what was going on, so I decided to do a case study, with the help of a tame accountant.

The Green

Jam Manufacturer and Distributor

Owner: Jane Enslin

Jane started The Green jam company after she inherited her grandmother’s sought after jam recipes. She had $1,500.00 to contribute to the starting of the company (Capital Contribution). She used $500.00 to buy the necessary equipment and another $500 to buy strawberries, sugar, lemon juice (consumables) plus jars and labels (packaging). She then cooked jam with $500.00 worth of materials to produce $900.00 worth of jam (including her markup).

Here’s what we have done so far in a very simplified table.

| Assets (01 March) | 2015 |

| Cash | $500.00 |

| Inventory | $900.00 |

| Accounts Receivable | $0 |

Jane received an order for $900.00’s jam from a large company who only pay on 30 days from date of statement (the order was placed on the 3rd of the month) which means the statement can only be generated in 27 days and payment can only be collected 30 days after that. This means that Jane will only receive the money for the jam in 57 days.

This is what our table looks like now.

| Assets (04 March) | 2015 |

| Cash | $500.00 |

| Inventory | $0 |

| Accounts Receivable | $900.00 |

The next month, Jane received another order for $900.00, but luckily this customer will pay on delivery. She also has to pay $550 for overheads, salaries and other expenses.

Our table now looks like this:

- -$500 to produce $900’s jam

- -$550 overheads

| Assets (02 April) | 2015 |

| Cash | -$1050.00 |

| Inventory | $0 |

| Accounts Receivable | $1800.00 |

Jane sent her jam to her new customer who did not pay her on delivery. Jane now has debt of $1050.00, no stock and no consumables. Her first order will only be paid at the end of May and her second order will probably only be paid at the end of April.

We know that she is expecting $1800.00, but at the moment she doesn’t have any money left to cook more jam. Jane now has a Cash Flow Gap. Her incoming capital and her outgoing capital is not on the same pace. Furthermore, she loses money in the form of interest payable to the bank or creditors.

- -$550 Overheads, salaries and other monthly costs

- -$15 for interest

- +$900 customer paid

| Assets (30 April) | 2015 |

| Cash | -$165.00 |

| Inventory | $0 |

| Accounts Receivable | $900.00 |

This is a very common problem for small businesses who have to pay expenses immediately and often have trouble collecting income due to limitations like time and resources. We can see how Jane’s accounts are moving towards a negative balance although her pricing covers all her expenses.

Jane is not ready to give up yet, so she goes further into debt to cook jam for more orders. If she loses $15 every month due to interest, her possible profit will turn into a loss.

Another +$900 order and the table looks like this.

- -$500 jam production

| Assets (15 May) | 2015 |

| Cash | -$665.00 |

| Inventory | $0 |

| Accounts Receivable | $1800.00 |

At the end of the month, the table changes.

- -$15 for interest

- -$550 for overheads etc.

- +$900 customer paid

| Assets (31 May) | 2015 |

| Cash | -$330 |

| Inventory | $0 |

| Accounts Receivable | $900.00 |

- +$900 customer paid

| Assets (15 June) | 2015 |

| Cash | $570.00 |

| Inventory | $0.00 |

| Accounts Receivable | $0.00 |

- +$900 Order

- +$900 stock

- -$15 interest

- -$550 overheads, salaries etc.

| Assets (30 June) | 2015 |

| Cash | -$995.00 |

| Inventory | $900.00 |

| Accounts Receivable | $900.00 |

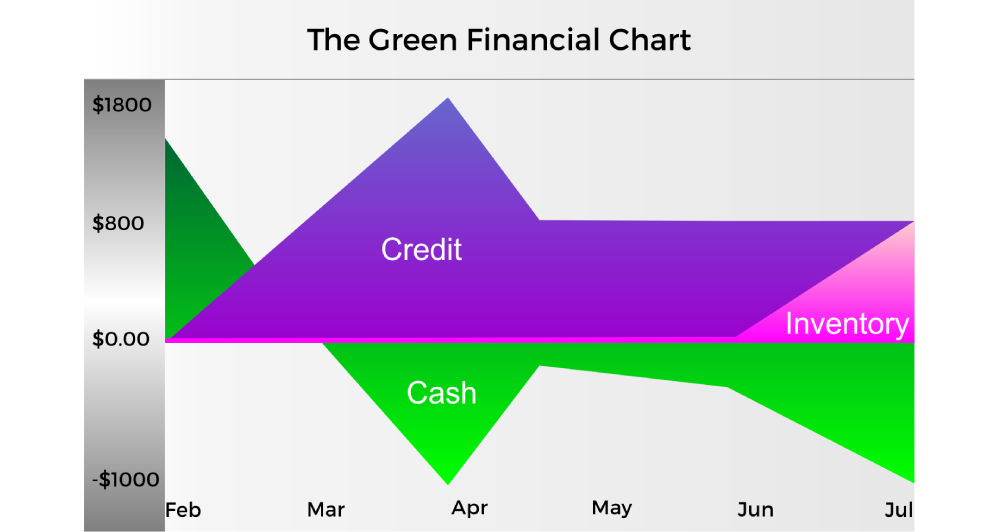

The chart above reflects the transactions indicated above. We can clearly see that “Credit” is the dominating influence in Jane’s financials.

Thus we see that small companies like Jane’s have to be careful before doing credit transactions. Even if your pricing covers all your expenses, you can still lose money if you have to wait for money to pay your expenses.

Remember, you don’t have to accept the customer’s payment terms without your say. There are a few clever tricks to avoid this scenario:

- If a big customer wants to pay on 60 days, you have to raise your price by at least 10%. Remember, your pricing system was developed with immediate payment in mind.

- Ask for payment up-front. You don’t get that which you do not ask. You’ll be surprised at how many companies say yes.

- If you deliver a service and your customer wants to change the terms to 60 days, you can inform them that you will bill them 30 days before the completion of the service. The payment terms will then be 30 days after completion date.

- Enforce your credit terms. Spend several hours a week, checking your invoices and phoning your customers to enforce your credit terms. Sometimes it will embarrass your customer but it will very rarely affect your relationship with them.

- You can offer early payment discounts to make sure you have an ongoing cash flow. Discounts are a great way of asking for money upfront too.

We’re not all CFOs, but we all have to work with money. Follow our blog for more layman’s lessons on money matters.