Most managers can agree: you can’t improve what you don’t measure, particularly when it comes to your company’s finances. While budgets might not be the most glamorous topic, they are often the hidden hero behind a company’s greatest successes. Budgets play a critical role in helping managers make smart decisions about spending and allocating resources, and they serve as a way to set targets and measure performance.

What is important to understand here is that budgeting isn’t just about collecting financial information or setting limitations on spending. You can also leverage different types of budgets to help you accomplish specific business objectives.

In a two-part episode of The Gross Profit Podcast, called Successful Budgets, we sat down with Ryan Cowden to discuss the massive impact budgeting can have on controlling a company’s spending.

In this article, we’ll go over five types of budgets that we mention in the podcast, as well as some tips for using budgets to drive action within your organization.

[content_upgrade cu_id=”4749″]Free Download: 5 Templates to Support a Successful Budgeting Strategy[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]

What Should a Budget Accomplish?

When you think about a budget, how do you define its purpose? Are budgets a sort of guideline or recommendation, or do they mean something? Think about this: when you look at your numbers, how many times have you realized, “Wow, this account hasn’t hit the targets that I thought it would, and now I’m looking at a loss this month?”

A budget can help you avoid these kinds of surprises by establishing accurate, reliable benchmarks, and then using them to inform your business goals. Getting to that level may require some adjustments to your strategy as well as your internal culture.

Adopting a dynamic approach to your budgets will give you a more accurate view of your numbers, with more information to help you make smarter decisions.

Static Budget

A static budget is a budget designed to be fixed throughout the duration of a predetermined period, and it will remain unchanged regardless of any fluctuations that occur within that time frame.

Static budgets are often used by organizations like government agencies, schools, and non-profits that have been granted a specific amount of money for a specific period. Because these organizations are operating on a fixed amount of funding, they don’t have the flexibility to make adjustments to accommodate unexpected expenses.

In other cases, companies use fixed budgets as a forecasting tool or a way to measure how funds are managed. For example, senior management might compare the performance of each manager’s department based on how well they can stick to the amount projected in the initial budget.

Zero-based Budget

Zero-based budgeting is a method based on the principle that income minus expenses will equal zero. What this means is that you’ll allocate all of your profit to covering expenses, paying down debt, or reinvesting funds into more productive parts of the business. A core component of “ZBB” is that budgets are built based on what you’ll need for the upcoming period.

By contrast, traditional budgeting methods include incremental increases based on historical spending. For instance, you might increase the budget by 3% to account for slight price increases in raw materials.

Zero-based budgeting instead starts at zero and requires budget managers to justify every expense, with this oversight functioning as a way to economize costs instead of just focusing on revenue.

ZBB can be a time-consuming practice, but it’s an effective tool for setting top-down cost reduction targets and helping to build a sustainable company spend culture. This approach could be an effective short-term solution for companies that need to get spending under control.

Rolling Budget

Rolling budgets demand a bit more attention than a yearly static budget, but they offer a bit more flexibility, allowing for periodic updates and ongoing forecasting. The benefit is that rolling budgets offer improved risk analysis, particularly in industries where there are a lot of fluctuations.

Incremental Budget

Incremental budgeting is a budgeting process that increases the previous year’s budget to account for slight changes in operating costs. This is one of the simplest budgeting methods, as increases are added based on an established percentage rather than on an in-depth assessment of the factors that cause change to happen.

Despite its simplicity, many organizations avoid this method because it encourages departments to max out their budgets knowing that they’ll get more funds next year — essentially incentivizing managerial decisions that don’t save the company money.

On the other hand, that doesn’t mean an incremental budget is useless. If, for example, you’ve done a good amount of work on last year’s budget, you might decide, “Let’s increase our budget by 5%. Revenue’s going up by 5%, and we’ll need to increase our budget to accommodate the extra cost of doing business.”

From there, you might put together a quick budget and perform a top-down analysis that looks at what would happen if you increased everything by 5% for next year — and that might in turn give you a target for increasing sales.

Flex Budget

Flex budgets adjust to changes in activity or volume. Flexible budgets often consist of a series of budgets that help you plan for different outcomes. Our initial budget might plan for a 10% increase in revenue and an 8% decrease in costs, while the flex budget indicates a 20% increase in revenue and an increase in costs of only 4%. The benefit here is that flexible budgets allow you to quickly adjust to adverse conditions or take advantage of opportunities.

Part two of the Successful Budgets series looks at how embracing a budget strategy plays out on the business side of things. Here, we’ll look at some key areas like getting buy-in from the top, reporting on progress, and more.

Why You Need Buy-in from Senior Management

For better or worse, the attitudes and actions of senior management impact the rest of the organization. The C-Suite and the department heads need to be on board. While the benefits of budgeting should be clear, it may take a bit of reframing to sell a new approach to stakeholders not directly engaged in company finances. Make the connection between how hitting budget targets can affect key leaders on a personal level, and how it can help the organization move forward.

Additionally, you’ll want to make sure that employees get the chance to share feedback so that their opinions are heard and taken into account. People are more invested in company-wide initiatives when they realize that their input can influence company culture.

Why Successful Budgets Depend on Accountability

After securing buy-in, you’ll have to deal with the challenge of creating a culture of accountability. You’ll need to assign really clear responsibilities outlining what you expect from each manager, and then get them to take ownership of their contribution. This graphic from McKinsey underscores how building a cost culture must span several areas to set the stage for success:

- Set expectations — What needs to be done? What are the deadlines? What does success look like, and how will you track it?

- Be upfront about consequences — this is less about punishing managers and more about helping them understand how the organization suffers when teams fail to hit deliverables.

- Offer support — Do managers have the tools they need to implement reforms? Consider using your finance team as a resource, and focus on coaching your managers to be successful.

- Measure progress — Goals must be quantified and tied to a measurable metric.

Using Budgets to Set Targets

[bctt tweet=”Budgets can feel constraining, as the word has a connotation with being unable to spend money. However, budgets can actually represent something much more aspirational: targets that help organizations measure success.”]

And while that comparison may sound like an attempt to repackage the budget for other stakeholders, budgets really are more like targets, and they must be met in order for the company to be successful.

You might say, “Our profit target is x number.” The C Suite sees the value in terms of budgets laying out a path for making money. On the other hand, your department managers see the value as defining the expectations for them to keep their jobs, get paid, and maybe even earn that pay raise.

Another example might include just taking a look at your sales. In looking at the numbers alone, you might see $100,000, $500,000, or even a million in sales — but without context, you have no idea whether those numbers are good or bad.

Budgets provide context, by reviewing those incoming sales against overhead, expenses, and other costs associated with running a business. How much do you need to earn just to cover expenses? To be profitable? To grow? With a budget, you can see that you’ve brought in $500,000 in sales and track that performance against your target—if the target was $400,000, then you can say, “Wow, we’re up $100,000.”

Or, if you only brought in $200,000, then you can look at all of the contextual clues that caused things to veer off course.

Best Practices for Reporting

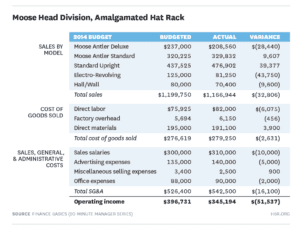

Building on this idea of using budgets to set targets, you’ll need to develop a reporting process that shows managers what budget information is relevant to them. Our recommendation is that you keep reporting periods relatively short — say, about every month or so — and run a variance analysis on every report.

The idea is that managers receive timely feedback, so they can easily answer questions about any unexpected variances. If you wait too long — weeks, months, or even longer — then the manager has moved on to other things and may not be able to offer much insight.

For example, if a manager turns in a report at the end of November, she should receive feedback from the C-Suite by the 4th or 5th of December.

This time frame gives finance the chance to comb through the budget and compare it against the company’s accounts — and a few days later, meet with the department manager to discuss questions, wins, and missteps.

Finally, Successful Budgets Should Inspire Action

In the end, the most important thing to keep in mind is that a successful budget strategy should be action-oriented. When we start putting together our budget, we need to compare the projected numbers against the actuals, and then ideally take action based on variances.

Think about it this way: what’s the point of learning that your team charged too much overtime last quarter or your sales team never seems to hit their quotas if you’re not going to take corrective action?

You need to either say, “You can only book x number of overtime hours,” or use these numbers as a starting point for further investigation. For example, you might ask sellers why they’re logging so much overtime, but failing to bring in more sales.

Do they lack the resources needed to reach prospects? Are they being asked to spend too much time on admin tasks that take them away from selling?

From there, you can start to come up with a plan for providing more resources — be it an investment in training, smarter technology, or both — and update your budgets to reflect those changes.

Get Top Rated Purchasing Software & Replace The Purchasing Book.

[content_upgrade cu_id=”4749″]Free Download: 5 Templates to Support a Successful Budgeting Strategy[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]