Departmental budgeting offers more control over spending at the department level, allowing teams to analyze performance in a granular way.

Benefits include risk management and the ability to see which areas are profitable and which are not. It can also help teams spot bottlenecks much faster than they would working under one budget for the entire organization.

Big picture, this strategy can help companies become financially sound, ensuring that there’s always enough money in the bank to cover employee wages, fund future projects, and pay vendors on time.

Here’s a look at how to set goals, work collaboratively, and leverage historical data for best results.

What is a Departmental Budget?

The term means pretty much what it sounds like. A departmental budget is a department-level financial plan that lays out spending for the upcoming quarter or fiscal year.

Managing a budget for your department is similar to managing a household budget—well, a household budget with a few more stakeholders and moving parts thrown in the mix.

With that in mind, departmental budget-makers must start with a solid foundation. This involves establishing a set of goals related to income and expenses, overhead, projected sales, and expected materials costs. Additionally, you’ll want to build in some cushion in case things don’t go as planned.

Start with the Goals

The first step in setting a departmental budget is coming up with a list of areas where you’d like to improve.

Be realistic but specific. Here are some examples of what your goals might look like:

- Track internal expenses more accurately.

- Identify opportunities to negotiate discounts.

- Forge relationships with local vendors to reduce freight costs associated with overseas orders.

- Set sales projections that reflect last year’s performance.

After you’ve set some goals, the next thing you’ll want to do is come up with a plan for achieving those results.

How can you increase revenue? Does that mean you’ll need more sales reps on the case?

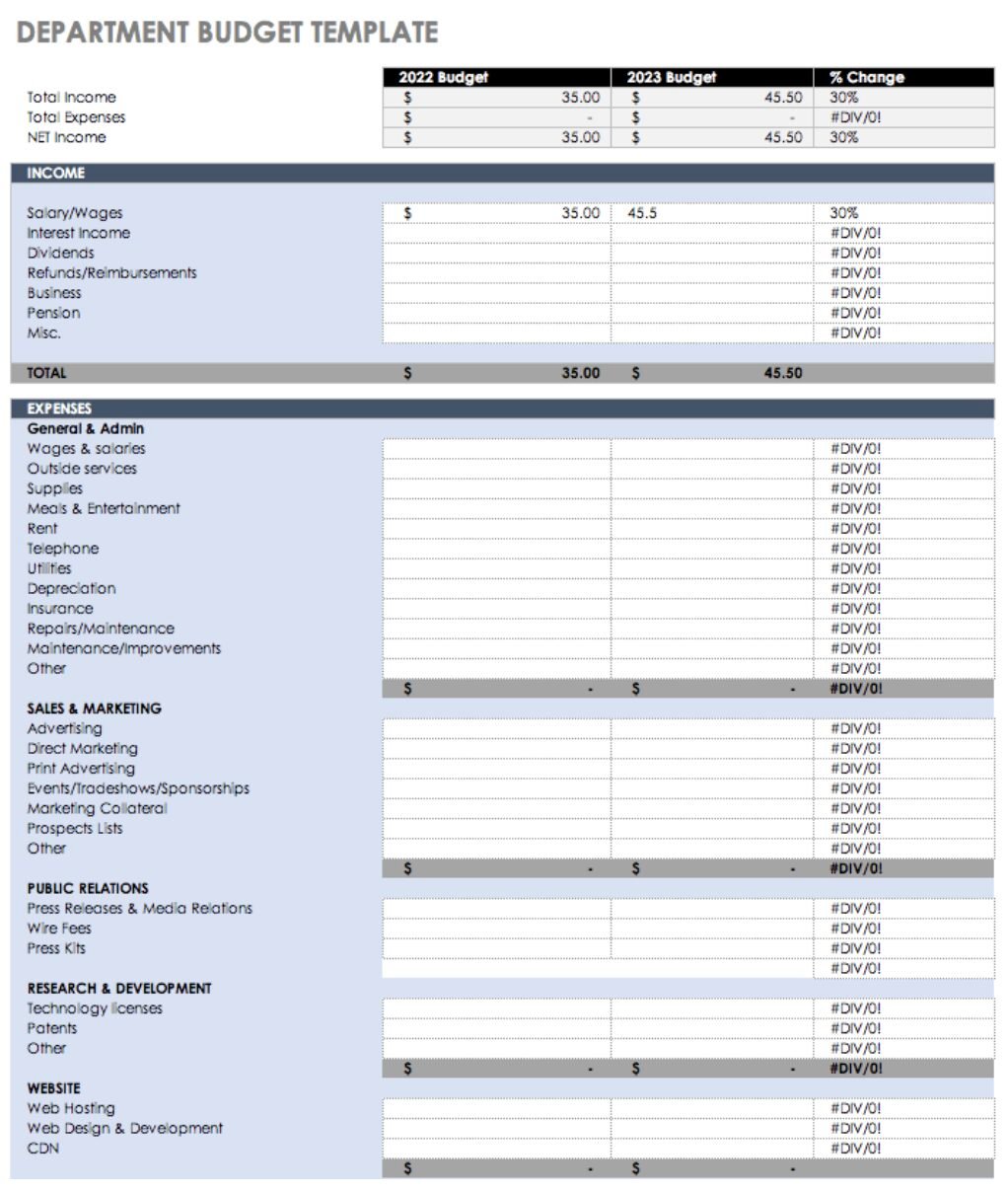

You might want to use a template like this one to help you keep track of all the items included in your budget.

Look at Last Year’s Budget

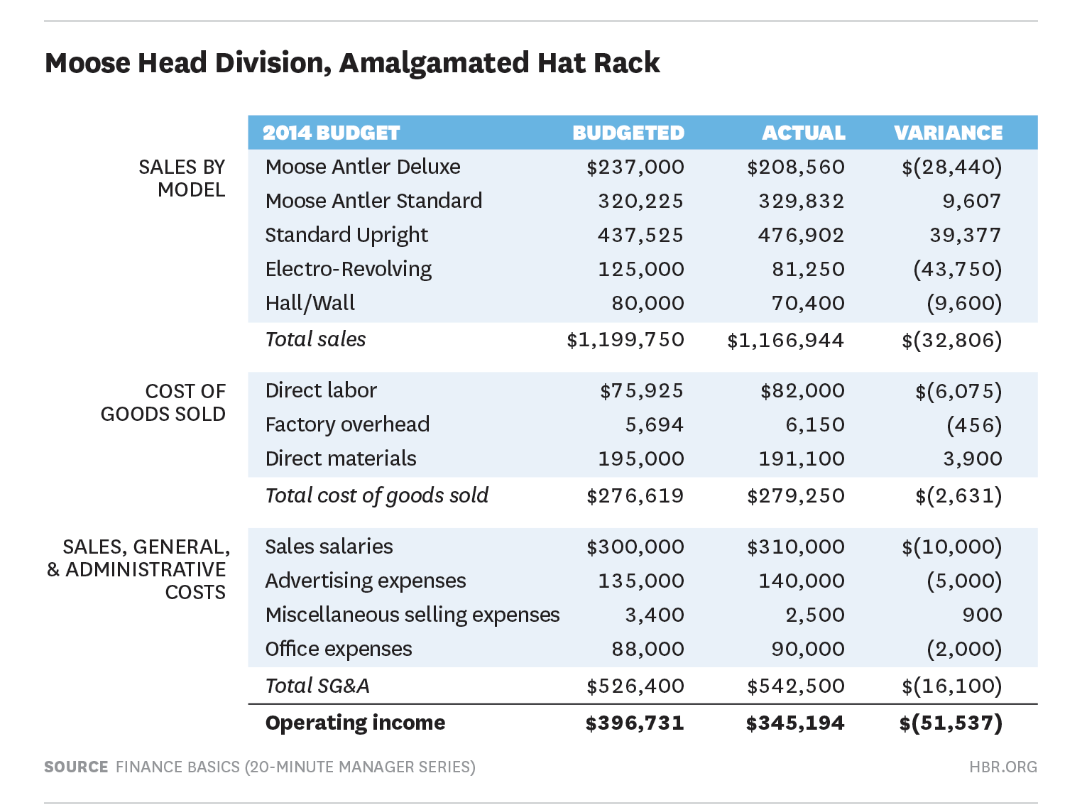

Typically, you’ll use last year’s budget as a starting point. In the example below, you’ll see a column for budgeted, actual, and variance dollar values.

Those line items in parentheses represent “unfavorable variances.” In other words, these are areas where the company didn’t sell quite as much as anticipated, or they spent more on direct labor than anticipated.

Consider what this information reveals about business operations last year. In this example, you’ll notice that the Standard Upright and the Moose Antler Standard were the only two products that performed better than expected in 2014. Knowing this, you might increase sales projections for these items in 2015.

On the flip side, what does the data suggest as far as the other items are concerned? What’s behind the disparity between the projections and the actual values? For example, why did the Deluxe model fail to meet sales goals?

Other things to think about include expenses and material costs. For example, even though you spent less than anticipated on direct materials, are there areas where you can reduce costs even further?

What about advertising expenses? How can you make sure that this year’s ad budget leads to more sales? In looking at this category, consider the types of campaigns you ran the previous year. For instance, were they focused on driving conversions or was there a plan to invest more in driving awareness, knowing that you might lose some money in the short term?

You might also consider these areas:

- Do your reps need more training?

- Are you planning to pursue additional projects this year?

- Will your cost of goods stay the same?

- Are suppliers likely to increase or decrease prices?

Consult with Others

As mentioned, there are quite a few moving parts to consider as you plan your departmental budget.

And that’s before you factor in all of the variables that might affect spending. In the last section, we looked at how you might review your past performance, identifying areas that might reveal where change needs to happen.

Assuming you’ve highlighted a few areas—think ad spend overages or low-performing products—the next step is taking that information to your colleagues for feedback.

Consider Your Company’s Financial Supply Chain

In the realm of procurement, the supply chain usually centers around the process of obtaining goods and services, managing supplier relations, and making a strategic assessment of all of the market factors that come into play.

On the financial side, you’ll have another perspective. Finance often looks at spending from an accounts payable lens, with an eye on cash flow and maximizing profits.

Which, of course, is a logical enough approach, but without collaboration, finance doesn’t always have a clear picture of price fluctuations and contract compliance.

Procurement, by contrast, approaches budgeting a bit differently. Their priority is to obtain the best quality at the best price while sticking to supplier lists and managing rogue spending.

And then there are other departments like sales and marketing that have their own expenses and operating costs.

So where does the overall budget fit into all of these different priorities? Well, one example is inventory. Procurement might know that additional inventory is required to keep operations moving forward while avoiding price hikes or shortages. When finance sees that extra order built into a budget, it may register on their end as unnecessary spending. The same might be said for things like allocating funds for advertising or including new hires in the budget for next year.

Keep in mind that you should approach budgeting as a team effort. Procurement can work on making deals with suppliers like early pay discounts or flexible payment terms, which can help improve company cash flow.

Finance teams can help departments develop the type of streamlined supplier onboarding that will ensure vendors get paid on time. Organizations on the whole can do a better job where expense reporting is concerned—creating a simplified, digital reporting process that holds everyone accountable.

One Part of a Larger Whole

As the budget manager, part of your responsibility is to remain in compliance with the policies and procedures your entire brand follows.

This might include things like ethical supply chain practices, charitable donations, and other expenses that might eat into the plans you have for your department.

The point is that a departmental budget needs to align with the company’s best interests, so cutting costs might be an exercise in compromise.

Another thing to consider here is how different departments view saving and spending differently. Procurement might automatically factor in the cost savings when they see a decrease in the price of raw materials. Finance, on the other hand, may be more focused on less spending compared to last year.

Often, price reductions aren’t reflected on income statements, at least not right away. This disconnect can lead the finance team to be wary of procurement’s claims.

As such, all teams—procurement, finance, accounting, and the rest—need to develop a shared set of standards and terminology that spans all budgets.

Keep in mind that budgets are living documents; they’re not set in stone. Prices fluctuate, plans change, vendors sometimes fall through. As such, you’ll want to make sure that you and your colleagues develop a plan for ongoing reviews, as well as a backup plan for handling unexpected changes.

Universal, Decentralized Reporting Helps Bring Budgets Together

Published over a decade ago, this article from the Harvard Business Review paints a bleak picture of budgeting.The article recommends moving toward a flexible solution—one with long-term goals measured by KPIs like profits, customer satisfaction, and cashflow.

The idea is that inflexible budgeting can get in the way of progress and dishearten front-line employees. Things have changed since 2003, but the takeaway is this: departmental budgets require employees to work together toward a unified goal.

Today’s budgeting isn’t confined to life in the spreadsheet. Instead, a cloud-based solution presents a better way to measure success while making sure you’re not overspending in certain areas. It’s essential for reducing fraud, preparing for audits, and tracking where your orders are.

Reporting needs to be easy and accessible. As budgets are sent to the C suite for approval, they’ll be reviewed, consolidated, and checked over for incompatibilities. In other words, departmental budgets are reviewed for how they’ll work with the rest of the company’s budgets.

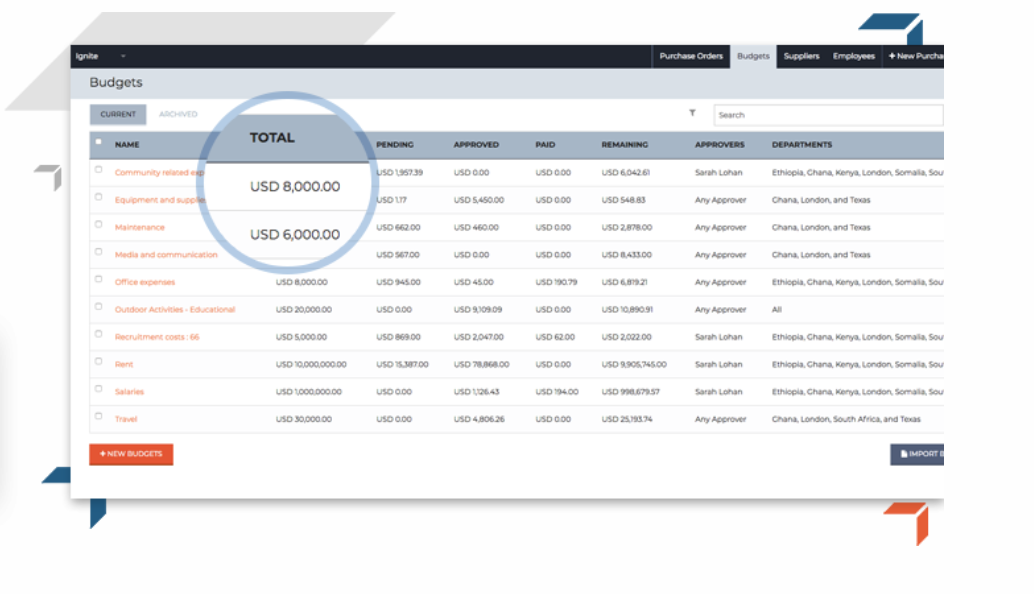

Once finalized, it’s smart to keep budgets in a decentralized location, allowing all stakeholders to track purchase orders and bill payments against sales, operational costs, and expenses.

We should mention that ProcurementExpress.com offers a few features that make decentralized budget monitoring a breeze, including spend allocation, a dashboard overview, and budget reports.

Wrapping Up

In the end, departmental budgets offer an opportunity for brands to get more granular when it comes to managing their finances. By bringing all budgeting data into a central, cloud-based location, teams across the organization can have a direct hand in helping their department reach its financial goals.

Get Top Rated Purchasing Software & Replace The Purchasing Book.