Budgeting is, of course, one of the most critical aspects of running any business. Albeit, maybe not the most glamorous. A procurement budget tells us what we can and can’t afford—and serves to inform our purchasing strategy. While a procurement budget can warn us when finances spiral out of control, they can’t prevent us from buying anything.

Procurement, as a function, focuses on a few different aspects. We’re talking logistics, marketing, IT, strategic sourcing, tendering, and contracting. And then there’s the day-to-day shipping and receiving stuff.

Failing to implement specific procedures–like ordering restrictions and project-based budgets–can take a toll on your bottom line. If you’re not sure where to start, here’s the rundown, as well as what you need to get your budget back on track.

[content_upgrade cu_id=”3571″]Take the steps toward an airtight budget—click here to download your budgeting checklist[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]

The Trouble with Budgeting

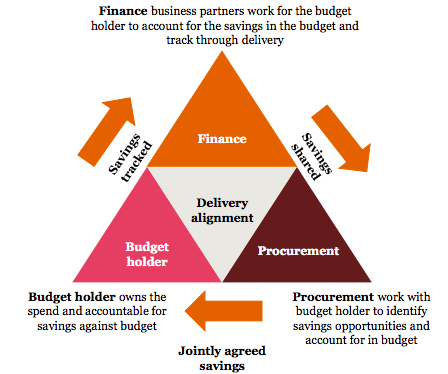

Often the trouble begins when the finance department can’t find the money that procurement has supposedly saved throughout the year. As such, you’ll need to start off on the same page. Finance, procurement and the CEO must get together and hash out a plan.

In the past, the role of procurement in budgeting has often been relegated to direct acquisition. Meaning, procurement isn’t always present in organization-wide budget meetings. As such, savings and goals often exist in their own bubble.

Still, a formal budget is required for the purchase of direct materials. This process ensures transparency across departments, as finance will be better equipped to identify savings against the initial budget. And, they’ll be aware of yearly price increases–since you record them in real time.

Most established procurement departments will have a pipeline of projects they’re looking at for the year. Taking some time to talk budget with all stakeholders allows you to account for all opportunities to save money.

Identify the Goods and Services You’ll Need

The procurement process starts when the business needs to make a purchase. These purchases are anything that is needed to run a business.

So, as you make a list of what you’ll need—you’ll also need to start planning your budget. If you run corporate events, you’ll need to source printed programs, name tags, and more. Using the same example, the process would start by identifying how many people you expect to come to the event.

So, from there, you’d start identifying the need: how many printed programs do you need? What size? When do they need to arrive—and get a sense of how much they should cost.

Explore Your Vendor Options and Make a Choice

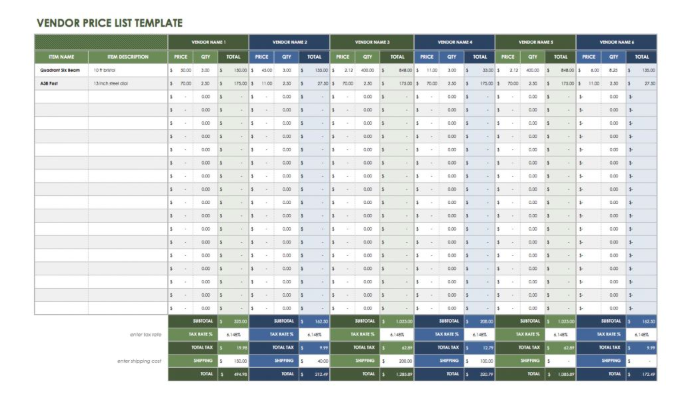

Here, you want to source potential vendors and narrow the search down to those who can provide the best price and quality. While this seems pretty straightforward—this process requires both a lot of nurturing and negotiation.

You’ll want to compile a short list of vendor prices, reputation, projected turnaround time, and customer service. Finalize your contracts and sign off.

Getting Everyone on the Same Page

Ultimately, the planning and implementation process requires a full effort from both the finance department and procurement. Agreeing on a budget, setting it in place, then making sure you meet those goals.

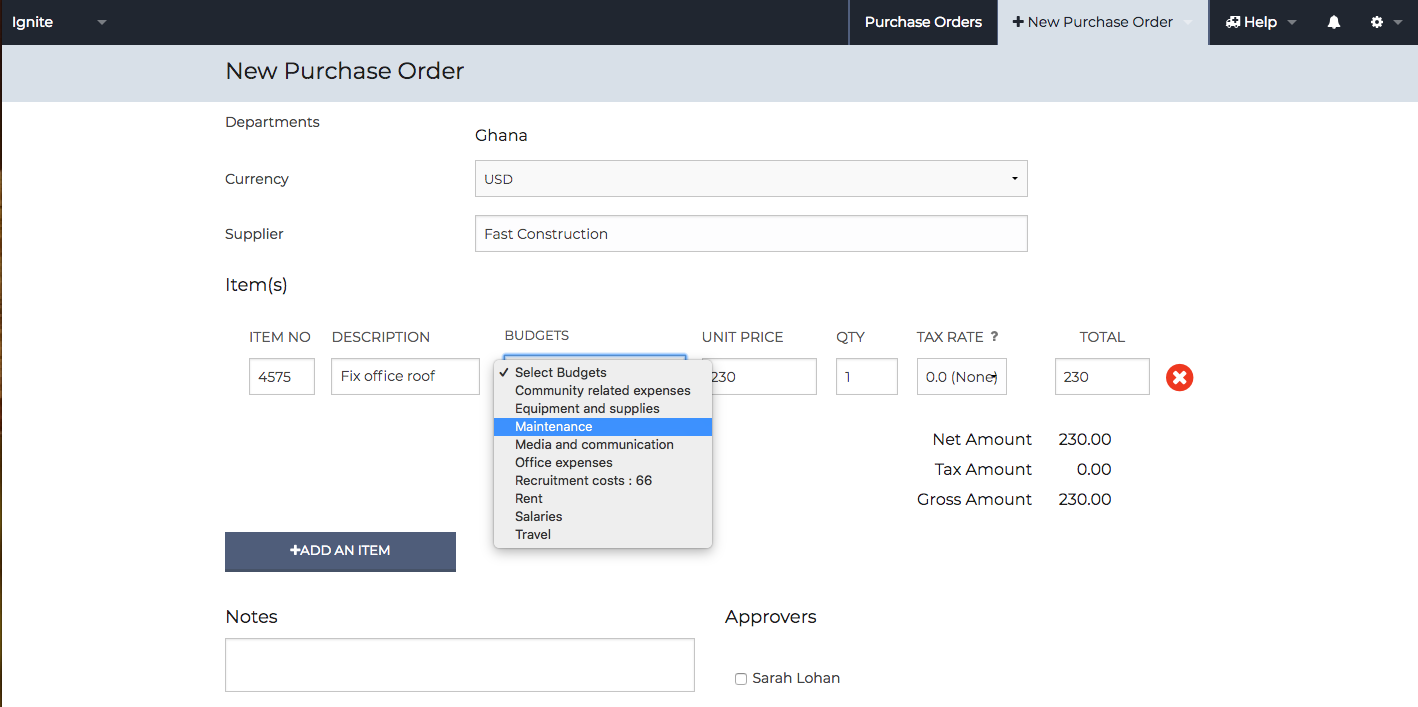

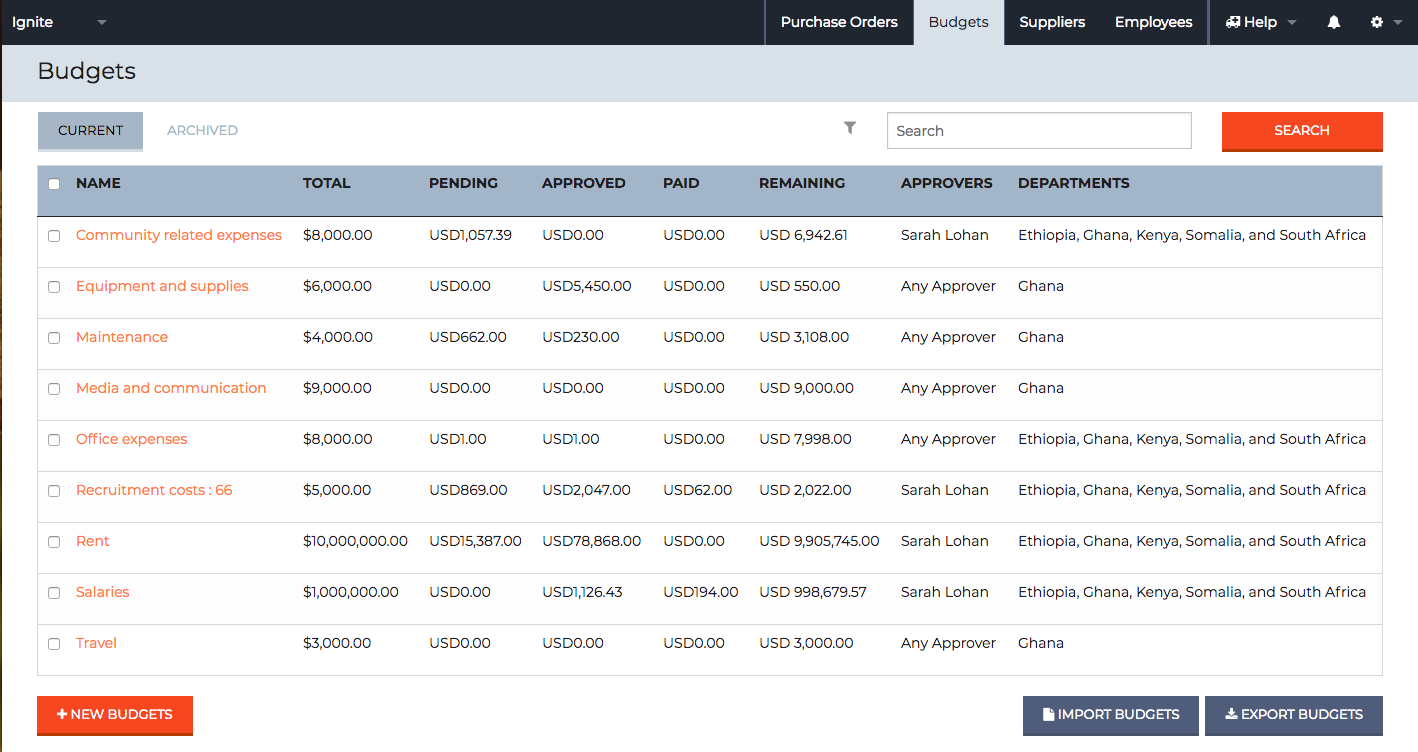

In this day and age, technology is going to be your best bet in getting everyone to sync up. ProcurementExpress.com (look, we’re a little biased here) allows you to set a budget inside the tool, then invite colleagues and collaborators.

As a business grows, the role of budget planning expands, too. There are more people in the mix, more departments, and higher costs. The whole goal of budget planning is to be prepared to handle all operating costs—while keeping the bottom line in good health.

For that reason, you will need to work with other stakeholders to set goals in as clear terms as possible.

This below example, courtesy of PwC, perfectly illustrates the relationship between the procurement team, finance, and the budget holder.

[bctt tweet=”Ways to Cut Back on Spending Straight Out of the Gate” username=””]

- Document and Review All Supplier Terms and Minimums—Create a master document that keeps track of all suppliers and your agreements with each. Order minimums, terms, and more will be recorded in this document.Consider using something like this:

Source You’ll also get a chance to eliminate suppliers you no longer work with from your system–so no one will slip up and order from them down the road.

Also, make sure you discuss your plans to cut costs with suppliers. They deserve a head’s up if you’re planning on changing your purchasing patterns. Additionally, they may offer you a better deal.

- Consolidate Orders—This will take some planning, but consolidating orders can cut down on delivery costs. Down the road, fewer orders mean less work for those in charge of receiving orders and processing payments.Consolidated orders mean making fewer unnecessary purchases. You’ll save money on direct costs, as well as indirect. Less time is spent putting away stock, processing paperwork, and making payments. You’re also wasting less warehouse space.

- Use Only Preferred Vendors—Have a dedicated supplier for each product you need. Multiple vendors that sell the same products can cost you extra money. Larger orders from a smaller selection of suppliers mean better relationships and bigger discounts.

- Check Up on Old Stock—Leftover stock is wasted money. It costs you money to store, too. Go over your existing inventory and see which items can be allocated to upcoming projects or sold off. In some cases, you may be able to recycle old stock and receive a rebate or tax write-off.

Adding Your Budget to Procurement Software Can Be a Game Changer

Traditionally, management has used the procurement budget as a tool for tracking, controlling, and forecasting the financial health of the business. Typically, budgets are prepared in some hierarchical manner by departments–separately and doled out along organizational lines to establish each unit’s budget.

Put the Right Controls in Place

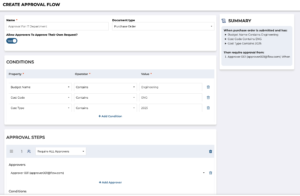

Once you’ve established a budget, you’ll need to create an air-tight approval process. Which team members have approval privileges? Do they have a specific limit?

Our system works so you can set your own workflows. Staff can submit their individual purchase orders, which will notify management.

Within the ProcurementExpress.com system there are four different roles:

- Company Admin: This person–perhaps a CFO, CEO, or controller–can manage user accounts and change company settings. This person is responsible for granting purchasing permissions and setting restrictions.

- Team Member: This person (or likely, multiple people) can create purchase orders, access specific budgets, and projects. They can only view POs that they’ve created.

- Approver: The budget owner or procurement manager, this person can approve or reject POs from team members.

- Finance: This role is for accounting/payables employees. They can edit any purchase order, budget, or supplier data. They also mark POs as fulfilled and paid and can override approvals made by the person in the approver role.

While every company is different, we opted for these roles (and rules) because they add some protective layers to your purchasing processes. For example, you don’t need to hold your entry-level employees’ hands as they walk through the ordering process–just approve or reject POs as they come in.

Accounting takes things a step further. They can use the system to look at the budgets–ensuring that POs have been received, supplier data is up-to-date, and so on.

Still, there’s room for customization. Within our system, you can create custom approval rules–for example, you can give individuals different purchasing limits, set alerts, and so on. This way, you’ll have plenty of visibility for overseeing all of the little things that impact the bottom line.

The budget control allows companies to compare actual performance against the goals laid out during the planning stage.

Benefits of Adding Procurement Software into the Mix

Now, there are other procurement software choices on the market—so it’s expected that they’ll all work a little differently. But here are some of the budgeting benefits you’ll find with ProcurementExpress.com.

- Users can place purchase orders and the person responsible for approval will automatically receive a notification.

- You can set up custom approval routing. Every department is set up a little differently, so these customizations make it work for your organization.

- Without procurement software, communications get stalled. We get stuck waiting for approvals or looking for a lost purchase order. People get bogged down in a mess of paperwork. Adding technology to the equation means you’re no longer scrambling to find old POs and invoices for accounting at the end of the year.

- Here, you get a searchable database of all transactions—so you can quickly look at whether you’re staying within your budgetary goals and make adjustments from there.

Our software requires that POs be connected to a budget or a project. If you don’t have a budget, you can use the system’s default to get past this.

However, we put this in place because, if used correctly, it functions as a fail-safe against overspending. When you start a new project—the idea is, you’ll do all the legwork—finding the right suppliers, negotiating a reasonable rate, rinse repeat until you’ve got all of your items in the system.

For a long-term project—set a total budget and track your progress. How much have you spent? How much is left?

Within that project, you can link purchase orders. And, you can have your staff submit purchase orders, which you—or finance—can approve. Essentially, this gives you some checks and balances that protect against overspend.

Fix Up Your Reporting Process

Having a digital record of your procurement activity makes this “final budgeting phase” way easier. One problem we see quite often is, many organizations will wait until the end of the fiscal year to track performance.

Instead, this should be an ongoing effort. For example, regular check-ins function as a way to get companies to slow down on their spending or even step in and source a more affordable vendor.

Here, the searchable database pays off. As such, you’ll need to keep all purchase documents so bookkeeping can evaluate the amount spent, saved, and received.

Final Thoughts

In the end, the biggest factors in reducing your spend are technology and collaboration. It is essential that procurement, finance, and the C-suite are on the same page.

Understanding the role of procurement and how your department adds value to the whole organization is critical for a transparent, high-functioning organization.

There are so many ways to cut back–but proper tracking, a supportive team, and minimizing waste–all stand to boost the bottom line. With the power of technology.

[content_upgrade cu_id=”3571″]Did you get your copy of our Budgeting checklist? Click here for the free download.[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]