Expense reporting demands a different approach than say, managing your purchase order process or tracking vendor performance. It’s something of an outlier in the procurement world, yet, at the same time, equally important when it comes to managing your company’s finances and the method you use to report expenses.

Expense reports make it easier to stay on top of tax responsibilities, build better budgets, and get a sense of what you can deduct come tax season. They also help you get ahead of employee fraud and misused company cards.

Here’s what you need to know about how to report expenses, and why you need a solid policy standing behind you.

[content_upgrade cu_id=”4495″]Get the bonus content: The Expense Report Checklist–Download your free copy here for a little extra guidance[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]

So What Should a Report Include on Business Expenses?

Expense reports can vary by company, and they include several fields specific to the relevant industry.

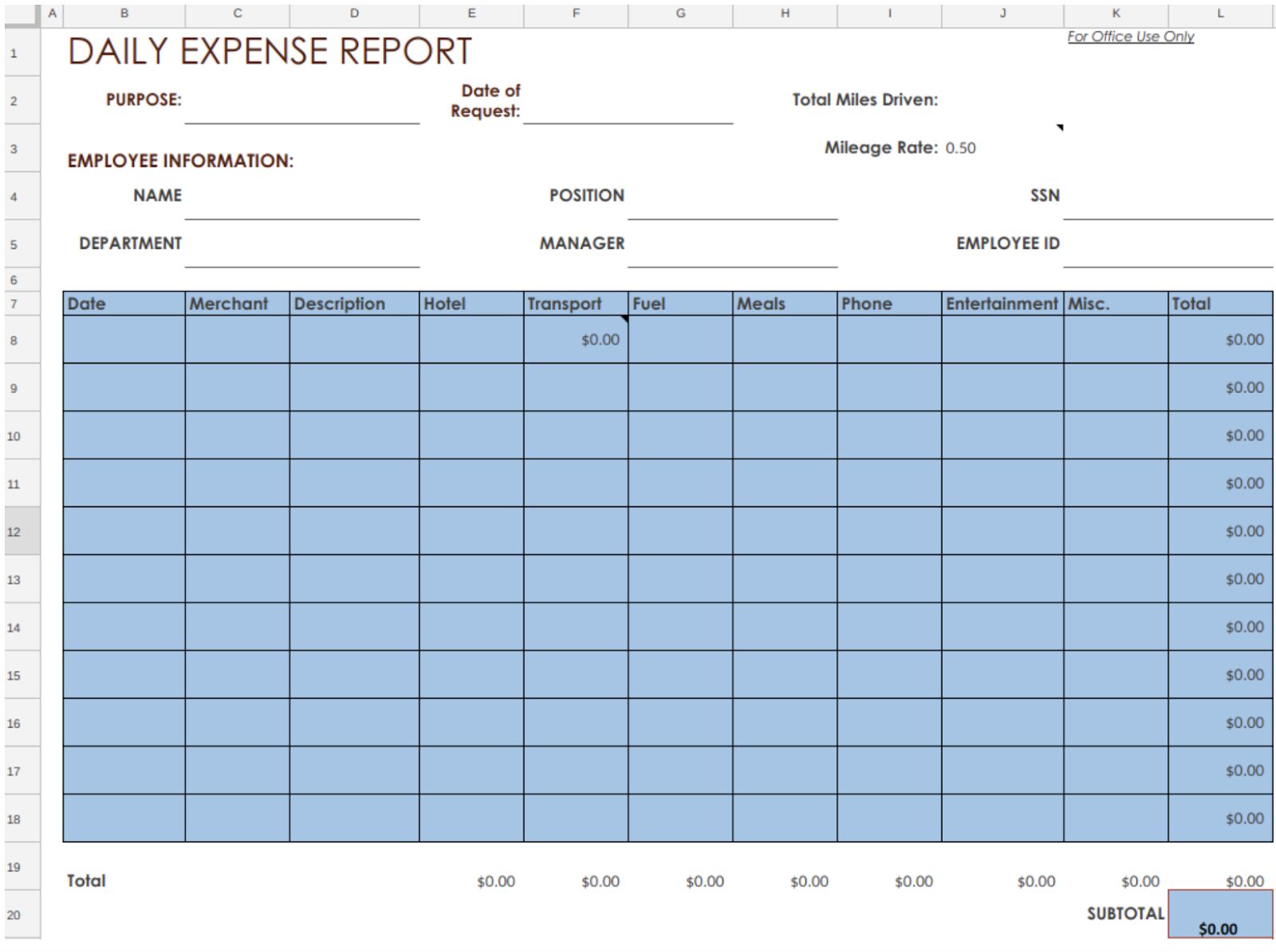

Still, in many cases, they follow a pretty basic template:

- Employee/contractor name and payment details.

- The date the transaction took place (should match the date posted on the related receipt).

- Expense category (think operating expenses, travel, contractor wages, etc.)

- Amount (again, should match what’s recorded on the receipt).

- Subtotal for each type of expense (travel, entertainment, mileage, etc).

- Total amount for reimbursement.

Again, though the amounts may vary based on the industry and on how your organization tracks finances in general, once you define your required fields, you’ll want to standardize your template.

Different Types of Reports on Expenses

So, what actually counts as an “expense”? The IRS lays out some pretty clear guidelines stating that, as you might imagine, any reported expenses must follow these three rules:

- Expenses must have a business connection.

- They must be submitted promptly.

- Overpayment of expenses must be returned in a timely fashion.

Additionally, it’s worth pointing out that businesses will likely have different expense reports for different types of purchases. Here are a few examples:

- Contractor Pay and Other Variable Wages: Where fixed wages paid to permanent employees don’t qualify as expenses, variable pay like bonuses, commissions, and payments to contractors do fall into this category. Reports may be submitted by the contractor–in the form of an invoice or spreadsheet outlining work performed.

- Travel Expenses: Travel expenses include things like lodging, meals, airfare, mileage (i.e. anything associated with work-related travel). Travel and entertainment–or T&E–accounts for a huge chunk of company spending, so you may want to spend more time establishing protections like approval routing, automations, and perhaps even some guidelines for employees such as how much is reasonable to spend on a meal or what kinds of expenses are NOT reimbursable.

- Technology and Supplies: These expenses cover things like apps, software, and other tools used by employees while on the job. In this category, you’ll also find office supplies and other items meant to be used internally.

- Cost of Goods Sold: When businesses purchase materials with the intent of selling them later, they are recorded as assets within the company’s general ledger. Then, when the company makes a sale, the value of the purchase is expensed as Cost of Goods Sold.

Here’s an example of what a simple travel report might look like:

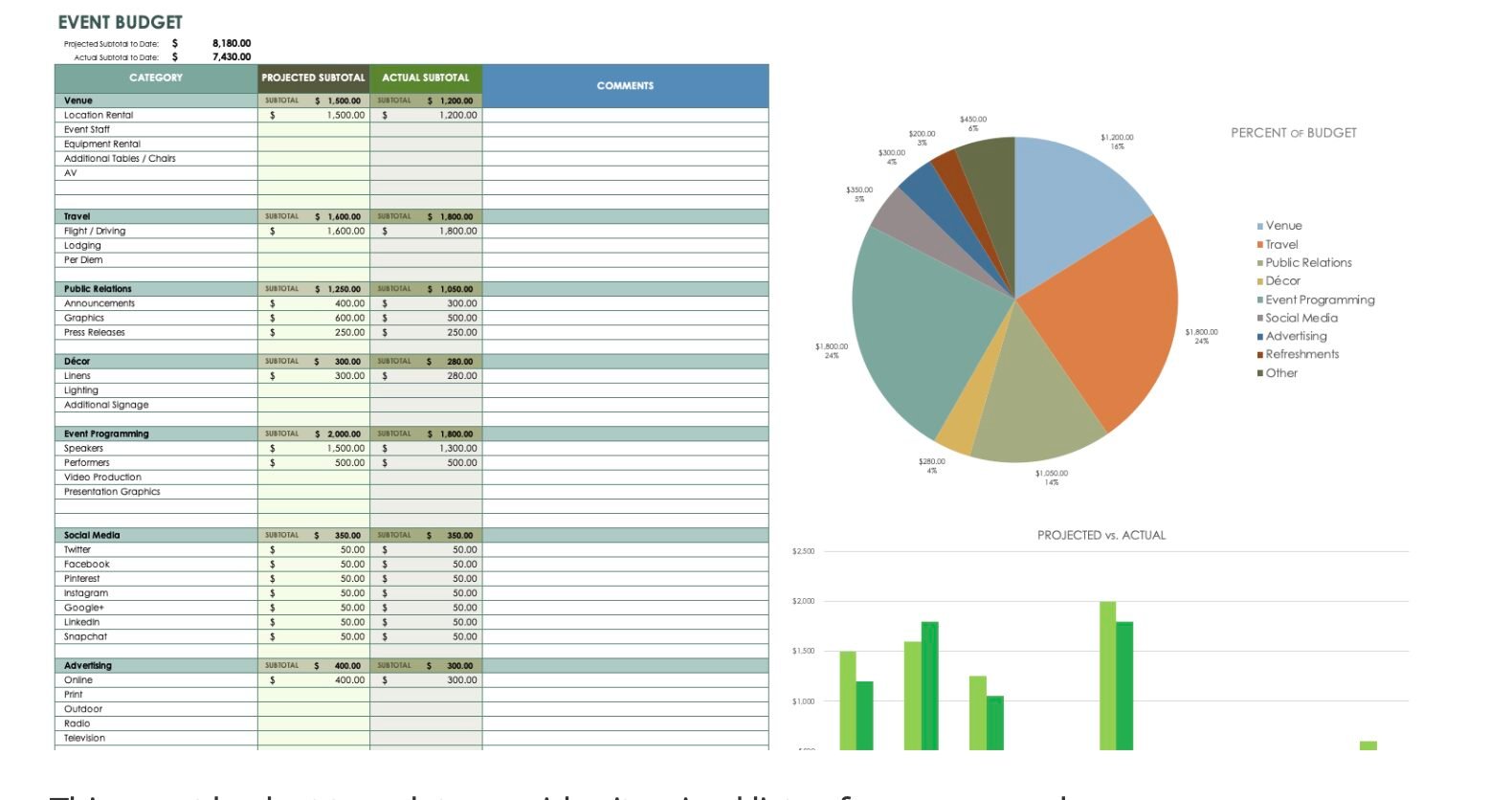

Or, on a different note, let’s look at a more complex expense report tied to an event. You might use something similar to track spending by project or cost of goods sold.

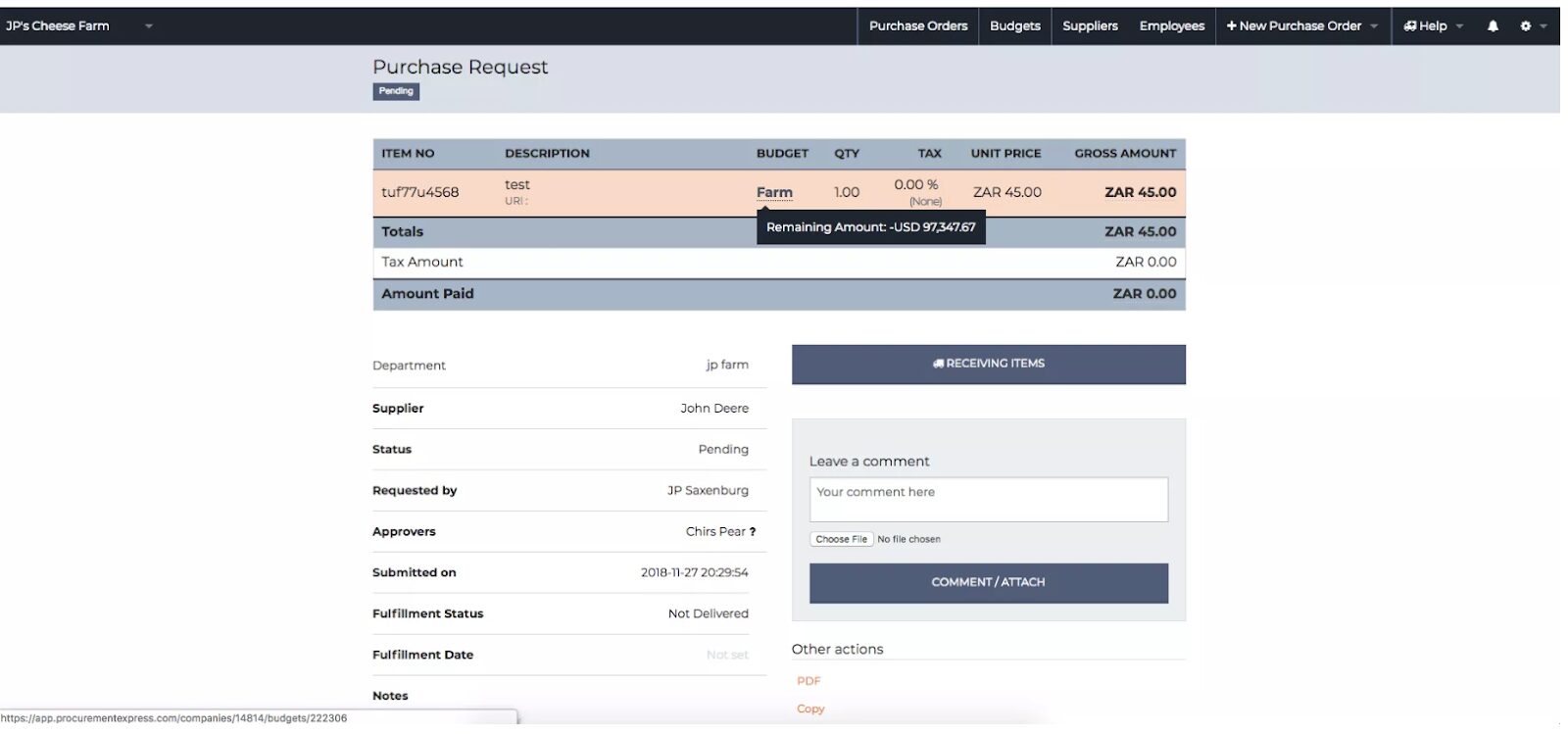

Within ProcurementExpress.com, you can create budgets–as in the example above, a budget that tracks the costs associated with an event.

When you order supplies, you can then link each PO back to that budget. Category fields can be automatically populated so that each order placed will automatically be deducted from the budget.

Here, you can see that this purchase request shows the approver how much money they have left to spend in this category.

While this isn’t actually an expense report, it’s important to understand that using a simple budget tracking system–along with digital reporting–gives companies the ability to control spending with minimal effort.

Establish and Document an Approval Policy

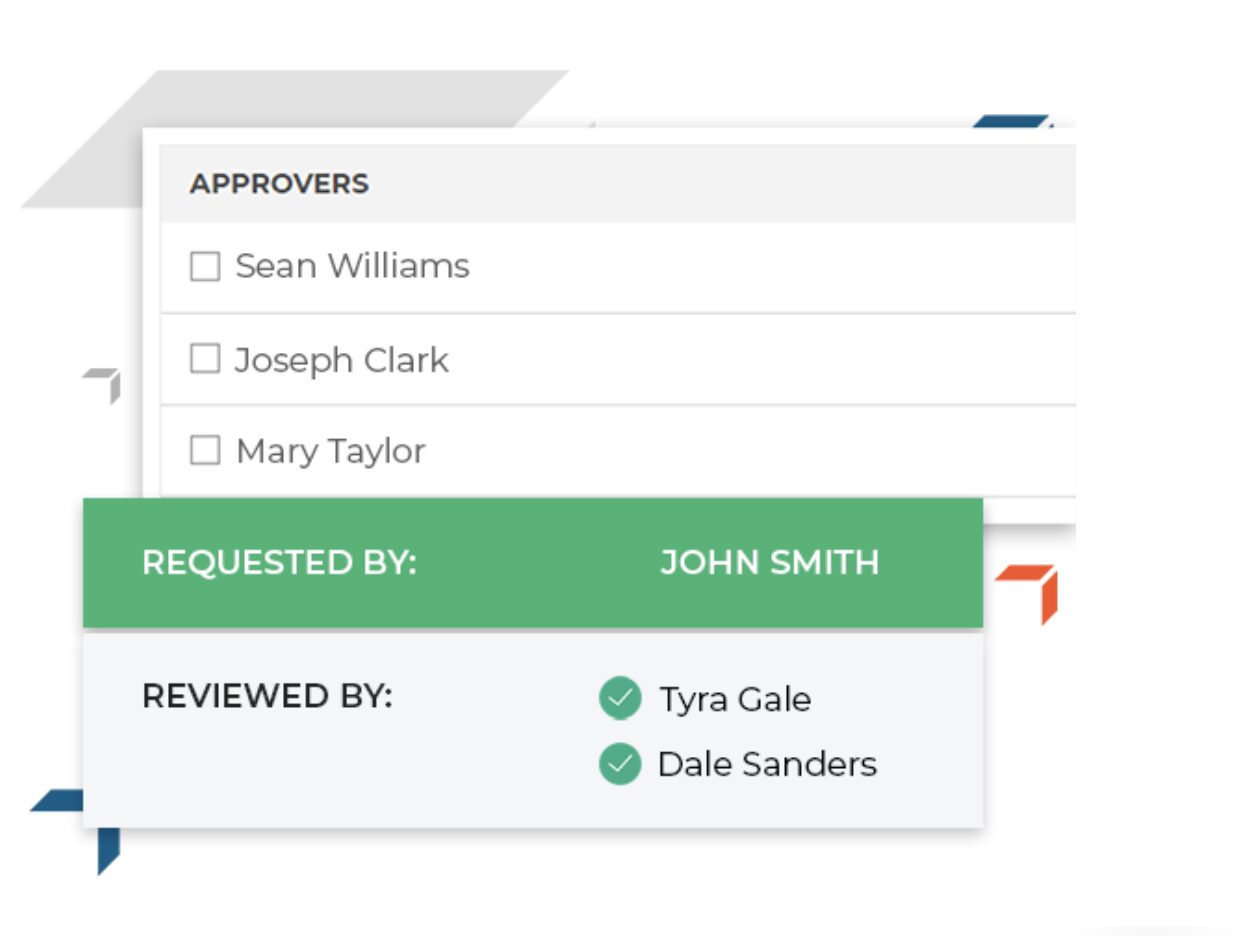

An approval policy helps teams ensure tight control over the reporting process. Just like you’d approach approvals in a procurement context, you can use ProcurementExpress.com‘s approval system to set spending limits and tailored approval flows based on your organizational structure.

Let’s look at a few things you should think about as you craft this essential documentation.

Decide Which Expenses Require Preapproval

It’s worth pointing out that many companies actually do require their employees to get all expenses pre-approved.

However, as is the case with procurement approval flows, sometimes it’s better to establish some clear guidelines and controls instead of adding too many steps to what should be a simple process.

Figure out what kinds of transactions need preapproval. If your sales team meets with clients regularly, it’s probably a bit much to ask for preapproval for things like the cost of eating lunch or filling up the gas tank.

For other purchases, you might want to build in some oversight that depends on the cost, as well as the employee type. For larger purchases like booking flights or accommodations for an out-of-town trip, you may want to implement an approval process.

What kinds of expenses does your company make regularly? Is there a dollar amount that requires approval? Do you have guidelines for how much is appropriate to spend on meals?

How Will Employees Submit Reports?

In the past, employees were left dealing with paper reports and getting managers to sign off on purchases.

Today, companies can use a range of apps to track spending, as well as prepaid debit cards, company credit cards, and more–making it easier than ever to keep track of per diems, mileage and more.

Who will be in charge of receiving expense reports? The founder of the company, an HR manager, accounting?

To minimize any confusion, it works best if there is one person in charge of collecting and processing expense reports. Ideally, this person also ensures that expenses are categorized appropriately, paid, and stored for later review.

Consider Implementing a Credit Card Strategy

While giving employees a company card might sound a bit risky, it’s actually a smart way to control spending and reduce instances of falsified receipts. There’s always a paper trail, and companies can review spending at any given moment, thus adding more transparency to the reporting process.

Other benefits include:

- Companies don’t need to worry about employees spending actual cash or requesting reimbursements. Instead, AP can pay the bill based on the schedule that works best for the organization.

- Credit cards often come with cash back incentives, travel rewards, or other benefits that may help you save money long term.

- You can set limits based on the amount spent or type of purchase, thus adding oversight without generating more work for supervisors.

If a credit card strategy makes you uneasy, consider issuing prepaid cards ahead of a business trip or to those employees who need to buy materials in the field on a regular basis. You’ll still receive the tracking benefits of a credit card, without giving a temporary or entry-level employee access to the credit line.

Make Things Easy on Accounting and Employees Alike

When reporting expenses is a significant chore that involves keeping track of receipts and using spreadsheets, chances are, you’ll see a lot of employees submitting reports late or loaded with errors.

This makes things difficult for accounting teams, who get stuck cleaning up the mess, updating spend categories and following up with employees who can’t remember to send in their paperwork.

Departments may want to implement their own solutions, such as project management software that tracks expenses based on projects, billable hours, or reimbursable expenses.

For travel, it’s a smart idea to arm employees with tools that allow them to capture receipts on the go, or give them prepaid cards so they don’t need to keep track of a bunch of small pieces of paper while focusing on other things.

Here are a few more ways to ensure that you set your team up for success:

Record Expenses Right Away

Recording spending as it comes in is one of the best ways to ensure accurate reporting, not to mention helping companies stay on budget and manage cash flow–priorities that, we’ll go ahead and assume, apply to pretty much any company on the planet.

To get employees on board with quick reporting, you’ll want to make things as easy as possible for them. Consider adding things like prepaid cards and expense tracking apps so they can easily track expenses while they’re out in the field or traveling for business.

Another thing to keep in mind is the amount of information you’ll require from employees. Stick to the essentials when it comes to creating a form–who purchased the item, why was it purchased, when did it happen, and how much did it cost? Asking for paper receipts and a detailed recap of the event creates extra work that many employees just won’t do.

Automate Whenever Possible

Be it approval routing, data entry elimination, or automatic reconciliation, companies that can automate some portion of the expense reporting process will save time–and likely, make it easy for employees to submit reports on time and with fewer errors.

Don’t make employees wait around for accounting to cut a check. Instead, automate the process. After the accounting team reviews and approves expense claims, they can schedule all reimbursements to go out within a week, 30 days, or whatever your organization feels is an appropriate turnaround time for repayment.

This way, you can set it and forget it, but rest assured knowing that payments will go out based on how cash flows in and out of your accounts.

Additionally, automation streamlines the entire process of expense tracking and reporting. For example, our software allows teams to automatically sync credit card statements with accounting software and budgets for real-time spend tracking.

Stop it With the Paper, Already

When you bring reporting into the cloud, the right tools can help you remove paper from the reporting equation.

While it’s essential to keep track of receipts and invoicing, digitizing and backing up your paper trail makes it easy to review expenses, and it helps teams stay prepared for audits, tax filings, and any questions that emerge regarding a particular transaction.

While we understand that some businesses may be a bit nervous about getting rid of the redundancy you’ll get from using paper, using multiple cloud-based tools to track spending means you can keep data secure, while making sure you never lose track of another analog report.

Software Integrations Are Huge Here

You’ll want to connect your expense reporting tool with your accounting software (or any other tools that you use) so that you don’t enter the same data twice. Not only will this save you time, but you’ll also reduce the risk of error and increase visibility–in turn, audits become easier and so does compliance.

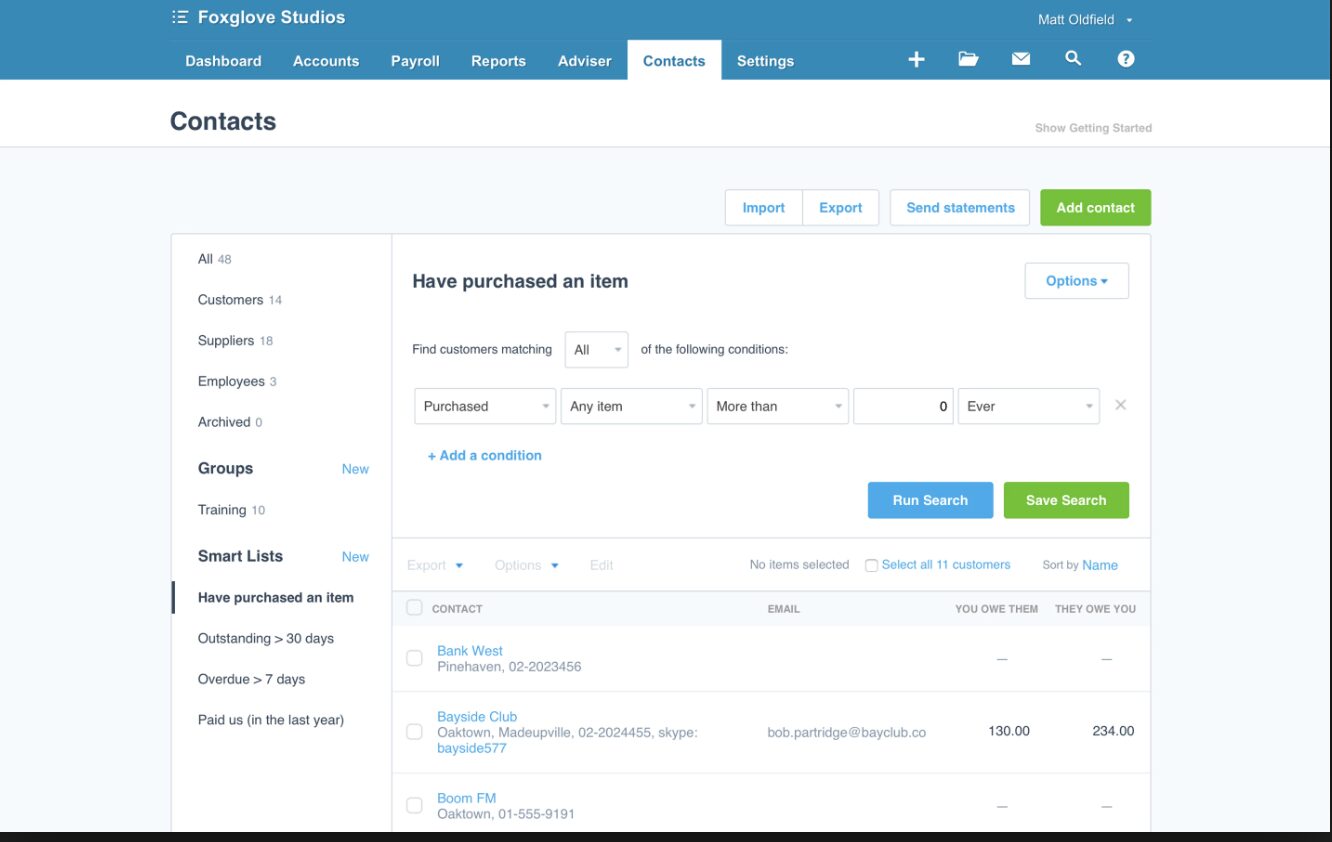

For small businesses, something like Xero’s smart lists (which integrate with ProcurementExpress.com) can help you review past transactions with ease.

Wrapping Up

Expense reporting doesn’t have to be hard, but you do need a system that combines straightforward spending policies with the right technology. ProcurementExpress.com may be known for its purchase order management tools, but it also comes equipped with some expense tracking and reporting features designed to make sticking to a budget easy.

Sign up for your free trial to check out all of our features, from approval flows to budgeting, spend allocation, and more.

[content_upgrade cu_id=”4495″]Free download: Your expense reporting checklist[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]

Get Top Rated Purchasing Software & Replace The Purchasing Book.