Procurement is responsible for obtaining the goods and services needed for a business to keep their operations running smoothly. It’s procurement’s job to make the best use of an organization’s budget, building strategic partnerships with suppliers, and reducing risks in the supply chain.

They also need to do all of those things in a way that aligns with the company’s financial goals. Which means finance, accounting, and other stakeholders need to collaborate on budgets, order restrictions, and supplier management procedures.

In these next few sections, we’ll look at how something as simple as a Quickbooks integration can help procurement teams embrace their evolving role as a strategic advisor and bring more value to the entire organization.

Let’s have a look:

[content_upgrade cu_id=”4807″]Free Download: 7 More Ways to Unite Accounting and Procurement with the Right Tools[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]

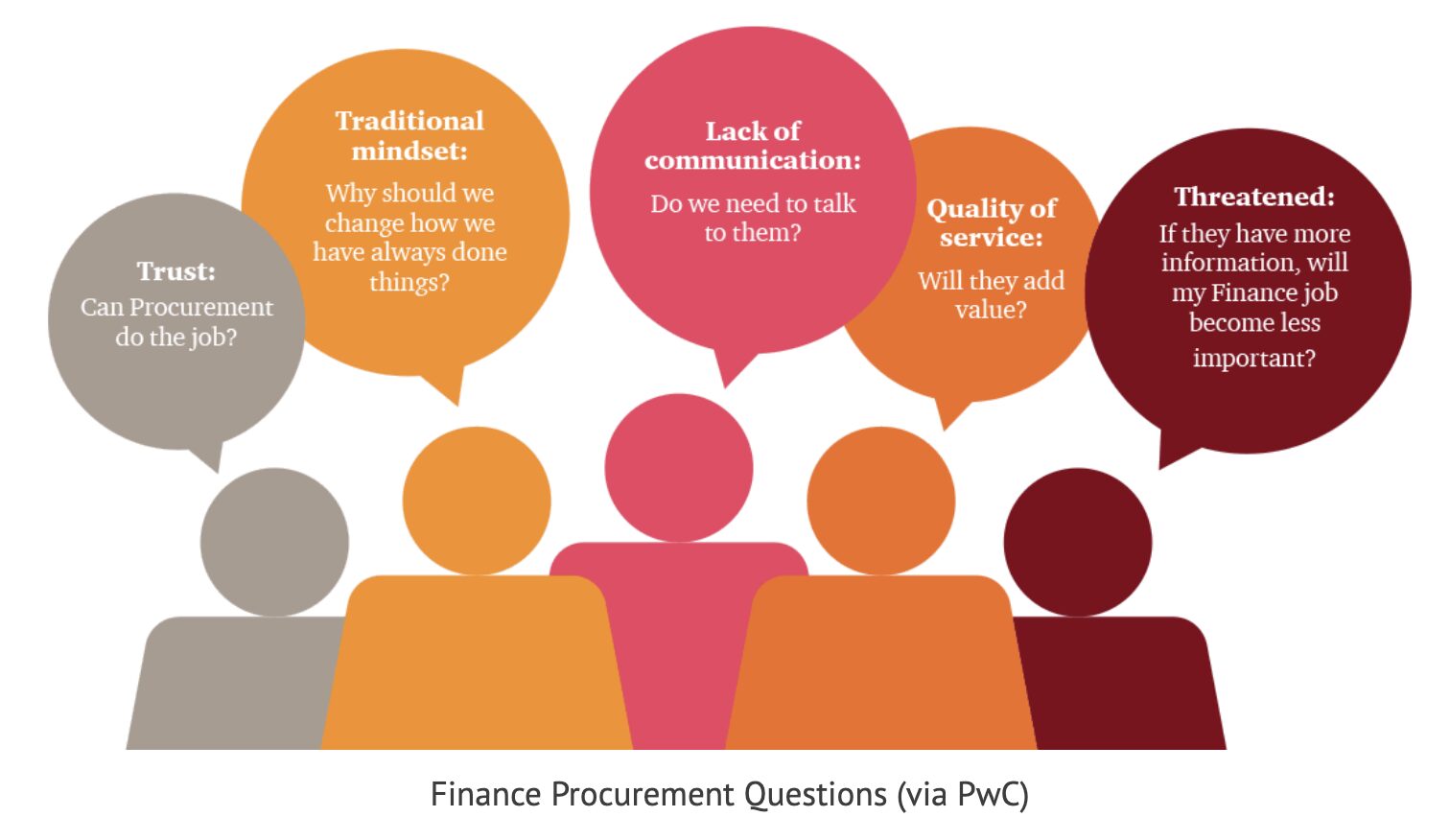

Finance and Procurement: What’s Behind the Disconnect?

Aligning procurement with finance and accounting is critical, as purchasing, payment processing, and accounting are all intimately connected. However, several factors like communication, trust, and resistance to change often stand in the way of transparency and collaboration.

Often, organizations add technology solutions designed to speed up certain parts of the payment cycle, but fail to implement those solutions on a holistic level. The problem is, automating disconnected processes won’t lead to better business decisions.

Access to data is critical in improving cost-effectiveness and streamlining internal processes. From budget planning to approvals, financial reporting to supplier relations, bringing financial and procurement into one central location changes the game.

Informed procurement teams can function as advisors, and help organizations reverse-engineer costs and seek alternatives that add more value to the organization.

Custom Approval Flows Bring More Control to Non-PO Spending

Marketing teams may need to fund a new social media campaign or buy a few extra items for their trade show display. Salespeople expense meals and mileage from meeting with clients, and companies might prefer that IT managers purchase servers and software based on their expertise.

The problem is, when expenses come from all departments, it’s hard to tell who authorized a purchase, detect an invoice error, or guarantee that paperwork is submitted on time.

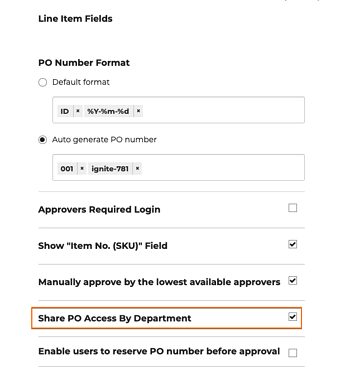

ProcurementExpress.com allows users to set spending limits for different approvers and route the right POs to the correct person. You might also share PO access by department, allowing departments to track internal purchases while limiting access to the rest of the system.

That ability to set custom rules makes budget management against varying requirements a breeze—and with the PEX-Quickbooks integration, spending data syncs with PO records and budgets in real-time, allowing for more predictable cash flow.

What’s more, adding controls allows procurement to restrict certain purchases to an approved supplier list, while syncing to Quickbooks brings non-PO purchasing data into purchasing reports.

Procurement now can focus on more strategic sourcing efforts like supplier innovation, risk mitigation, and negotiating deals—which, in turn, leads to more cost-savings for the organization.

Quickbooks Integration Links Budgeting to Real-Time Cash Flow

According to research from Hackett, top-performing organizations are more likely to view procurement teams as valued partners by the organizations, not administrators or gatekeepers.

In these organizations, procurement teams tend to take a more active role in budget planning and develop a deep understanding of the business’ requirements.

By connecting your procurement automation solution with your accounting platform, it’s suddenly a whole lot easier to link spending to budgets, and measure the impact on cash flow.

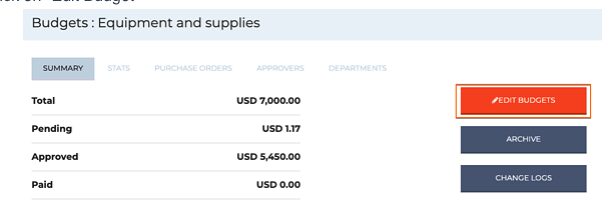

For example, if a purchase order is approved in ProcurementExpress.com, it automatically syncs to Quickbooks Online, as do any updates to active and archived POs. Then, when a PO is closed in Quickbooks, it’s marked as paid in PEX, and vice versa.

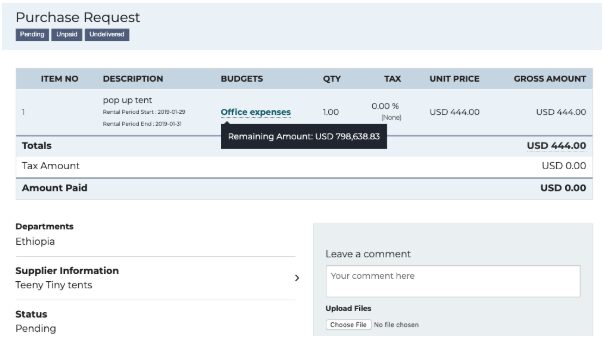

Users can allocate spending by project, customer, or department, making it easier to track budgets against actual spending on a more granular level. And, approvers can review purchase requests and make a decision based on the remaining amount in the budget.

Organizations do have the ability to update the budget, however, that capability is limited to finance or admin users. This offers some flexibility, while at the same time, restricts high-level decision-making to those with the authority to make those calls.

Quickbooks Integration Paves the Way for Better Reporting

With automated tools like e-procurement software and digital invoicing, the P2P cycle no longer involves manual processes like paper spreadsheets and siloed data. Instead, organizations can zoom out to identify opportunities for cost-savings, get ahead of risks, and make decisions based on historical data.

Alignment between procurement and the rest of the organization allows teams to do the following:

- Connect spend reporting and cost reporting

- Gain increased visibility into expenses

- Analyze consumption trends

- Use historical data to inform category planning/budgeting

Additionally, bringing accounting and procurement data together in one central location makes it easier for teams to benchmark performance across different business units and set realistic, attainable goals.

ProcurementExpress.com comes with built-in reporting tools that users can customize based on the metrics that matter most to them.

Supplier Management Made Easy

When AP goes to pay an invoice, they’re a few steps removed from contract negotiations and the specific terms that made it to the final document. As such, it’s easy to miss opportunities for early-pay discounts or make errors while entering supplier records.

ProcurementExpress.com’s Quickbooks integration offers a solution. For example, when new vendors are created in ProcurementExpress.com, that information automatically syncs to Quickbooks online.

The main benefit is AP data stays synced without any effort. This makes it easier to ensure that AP releases payments at the right time, eliminating late payments and errors that could put supplier relationships at risk.

It’s worth mentioning that procurement and accounting teams should monitor more than the invoices they’ve sent and received. Think supplier performance metrics, price tracking, and contract compliance.

Using our supplier management portal can help organizations keep track of performance metrics like delivery time, quality, and availability by leaving comments and attaching files to PO-invoice records.

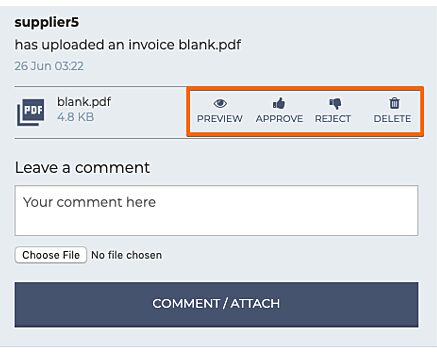

Suppliers can upload invoices directly, allowing finance and accounting teams to review them against the original PO before making a payment.

From there, the organization determines which suppliers bring the most value to the organization and can work with them to optimize demand and inventory planning, negotiate terms based on cash flow, and manage risk at the first sign of trouble.

Wrapping Up

While true alignment between procurement, accounting, finance, and the rest requires a culture and mindset change, the right technology can place organizations on the right path.

Together, ProcurementExpress.com and Quickbooks allow teams to track how money moves throughout the entire organization.

With one-click approvals, custom approval routing, budget tracking, and comprehensive reporting tools, organizations have everything they need to control spending and make smarter sourcing decisions.

Click here to learn more about ProcurementExpress.com’s Quickbooks integration and the benefits of bringing these two essential tools together.

[content_upgrade cu_id=”4807″]Free Download: 7 More Ways to Unite Accounting and Procurement with the Right Tools[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]