Purchase order financing, or factoring, is a funding method for companies that don’t have the cash flow needed to purchase inventory required to complete orders for their customers.

In this situation, companies will work with a PO financing company, who will pay your supplier to manufacture and deliver goods to your client. From there, the customer will pay the lender, who then deducts a fee before sending you your cut of the client’s invoice.

This financing method comes with a unique set of pros and cons—more on that later—but it’s best reserved for small or growing companies that need a quick infusion of cash to keep their operations on track.

For example, if you’re running a new business and you suddenly get an influx of orders all at once, you might not be able to purchase the materials needed to get those orders filled and delivered within a reasonable time frame. As such, the key benefit of PO financing is to help ensure that you don’t have to turn away business.

In this article, we’ll go over how PO financing works, what some of the pros and cons are, and why you might choose this approach over other types of business loans.

[content_upgrade cu_id=”4735″] Free Download: A Step-by-Step Look at PO Financing[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]

How, Exactly, Does Purchase Order Funding Work?

As mentioned up top, purchase order funding aims to help companies fulfill orders for their customers. This approach is typically best suited for smaller companies that don’t want to turn customers away, but don’t yet bring in enough money to pay for the supplies and delivery fees needed to fill an order.

PO funding differs from a typical business loan. You’ll still apply for financing through a third-party lender, but the PO financing company doesn’t send the money to your business account. Instead, they’ll actually send it directly to your supplier. These loans actually look more like an Afterpay or Affirm-type arrangement for small businesses, as the money goes toward a specific purchase.

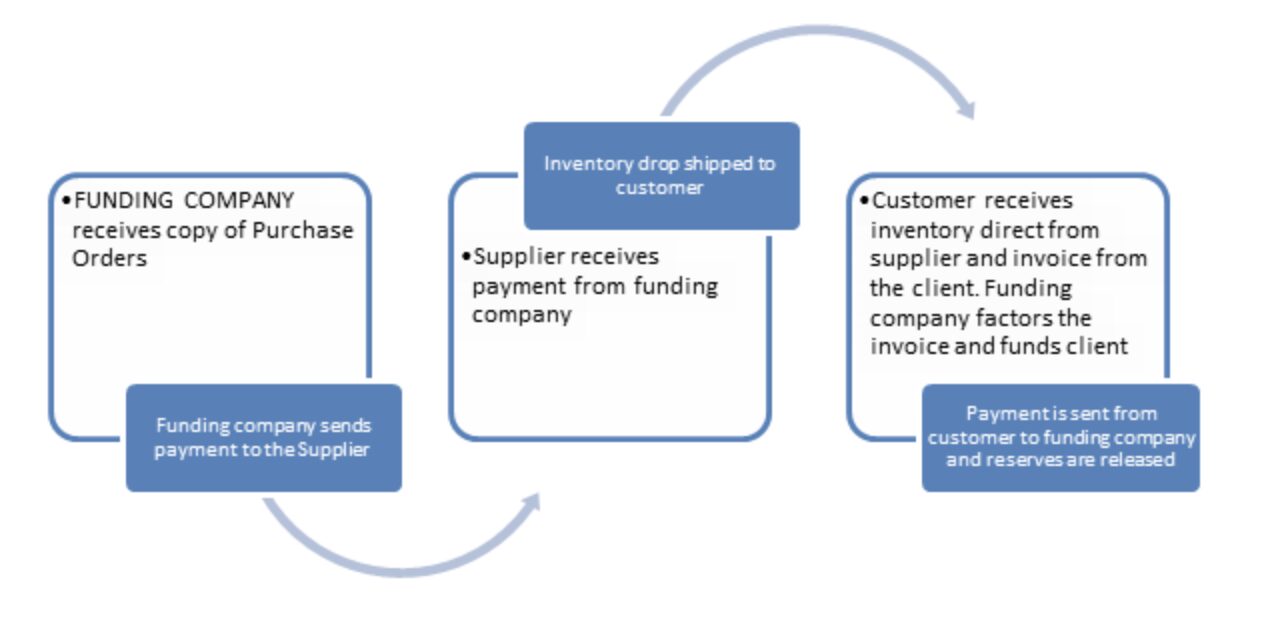

The process might look like this, a relatively simple series of steps:

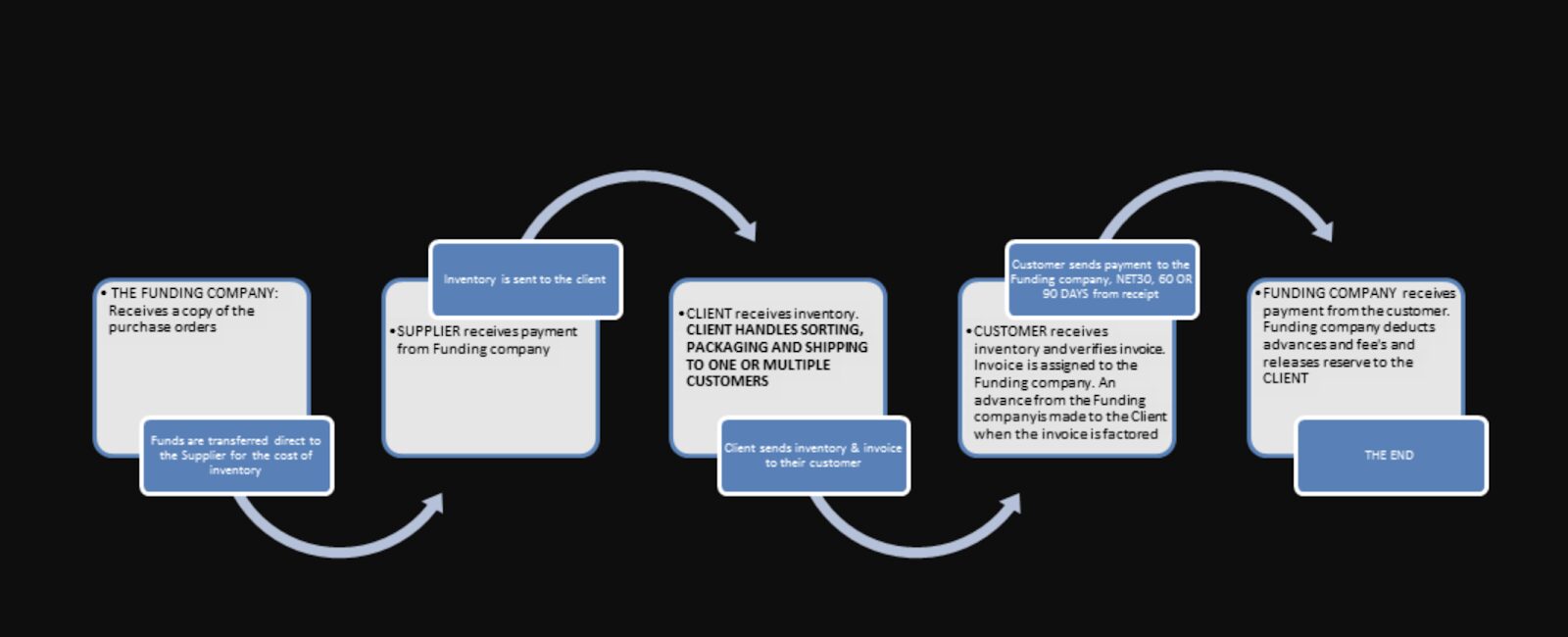

In other scenarios, things could get a bit more complicated:

Typically, you’ll see purchase order financing arrangements follow one of two options. With the first kind, a PO financing company will collect an invoice directly from the end consumer for a single order.

In other cases, you might set up an arrangement with a purchase order financing company to open a line of credit with a particular supplier. The line of credit is set up under the lender’s name, as this company will back the financing. This arrangement allows those with poor credit or insufficient assets to secure the materials they need to fill their orders.

From there, the supplier delivers the goods to the customer, and the customer then pays the supplier directly. The supplier then takes a cut and passes the remainder on to you.

Why PO Financing isn’t a Sustainable Funding Method

Like other types of loans, working with a PO financing company isn’t without its risks. Purchase order financing companies make their money by charging the borrower a percentage of the amount that they advance to the supplier. In exchange for providing the cash up-front to your supplier, you have to pay this fee to the purchase order lender.

Those fees are taken from the amount collected by the end-consumer. After the customer makes a payment, the lender returns the remainder of funds to the borrower, completing the payment cycle.

If you know anything about the role of procurement, or have read some of our blog posts, you know that this function is all about identifying opportunities to save money. Even if it’s 10% here or 2% there, over time you can erode your bottom line with things like interest rates and missed opportunities to cash in on rebates. As such, we don’t recommend working with PO financing companies unless you absolutely have to.

It’s worth pointing out that this strategy is best suited for those companies that need some extra help meeting client needs as they scale — it shouldn’t be treated as a band-aid solution for mismanaged cash flow.

Benefits of PO Funding

Purchase order funding can be risky, but it’s also a potential lifeline for companies that don’t have the cash flow available to take on new clients.

- Quick and Easy Access to Cash: With PO financing, lenders don’t typically subject borrowers to the same level of scrutiny associated with your typical business loan. In fact, many PO lenders can release funds within 24 hours.

- Collection Responsibility Falls on the Lender: With traditional bank loans, it’s the borrower’s responsibility to ensure that you A: get what you pay for, and B: that your customers make their payments on time. With PO financing, this responsibility falls on the lender instead. While you do have to pay a fee for this service, one of the key benefits of this financing method is that you don’t shoulder the burden if anything goes wrong.

- No loan installments: In most cases, the PO financing company takes a cut from the end-customer’s payment, then passes the rest of the earnings on to you. As such, there are no installments or long-term commitments to worry about that could impact cash flow down the road.

Cons of Purchase Order Financing

Unfortunately, for all of the “good” that comes with securing purchase order financing, there are also some serious “cons” to consider before jumping into this agreement. Here’s a quick look:

- PO Lending Companies Often Charge Upfront Fees: Traditional lenders allow you to repay your loan in installments. While this may be a burden down the line, it also means you’ll take less of a hit when the time comes to pay up. In many cases, you may even need to make a payment before earning money on the order.

- You Have to Get the Customer Involved: If you’re using a PO financing arrangement, the customer is the one that ends up paying the lender. So, you’ll need to bring this up with the customer ahead of time, which, if this is a new business relationship, may alienate the customer or erode their confidence in your company. They may not want to do business with a third-party lender–and bringing up this option may make them think you’re in financial trouble. How can they be sure they’ll even receive the product/service they ordered in the first place?

- You Don’t Receive the Full Payment: Though lenders deal with the risks associated with the deal, they take a cut in order to compensate for brokering the deal.

- PO Financing is a Short-Term Solution: PO financing isn’t designed to keep your company afloat for the long haul. It doesn’t solve your cash flow problems or an inability to properly manage incoming and outgoing capital.

Wrapping Up

Ultimately, PO funding can be a lifesaver for new or growing businesses that want to avoid reputational damage and lost income from turning away business. But, as we’ve mentioned throughout the article, it’s important to understand that this strategy isn’t really designed to support long-term purchasing activities.

To learn more about how ProcurementExpress.com can help you manage cash flow and save time processing POs, book a demo today.

[content_upgrade cu_id=”4735″] Free Download: A Step-by-Step Look at PO Financing[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]