“The fact is that one of the earliest lessons I learned in business was that balance sheets and income statements are fiction, cashflow is a reality.” – Chris Chocola, congressman, U.S. House

“The fact is that one of the earliest lessons I learned in business was that balance sheets and income statements are fiction, cashflow is a reality.” – Chris Chocola, congressman, U.S. House

Why is cashflow management important?

Cashflow is the substance that your business thrives on. Cash flows in from all directions and should be monitored, i.e. account receivable. The simple fact is, you need cash in your hand when needed. This is important as there are a lot of cashflow dangers that go undetected because it is not taken seriously.

The following are different tips you can follow to approach your cashflow in the right way.

Plan your projects backward

This may sound unorthodox and seemingly time-consuming, but if you begin your project planning process with a review of the last step involved first, the result could be quite rewarding. You usually end up with excellent results, instead of that feeling in your gut that your numbers just aren’t adding up. There are those little unforeseen costs that usually creep into your strategically planned project budget.

Tweet this: The simple fact is, you need cash in your hand when needed.

Implement a 12-month rolling cashflow forecast

“Companies need to make tracking cashflow a priority, and cashflow projections are a big part of that,” says Calvin Harris Jr. a certified public accountant and president of change management with Harvin Consulting in Columbia, MD. He also added “Often when business owners first start working on a cash projection, they realize how difficult it can be to predict into the future. The good news with projections, though, is they get much easier to update over time.”

Maintaining a healthy cashflow requires long-term vision. The 12-month Rolling CashFlow Forecast offers a more in-depth view of your finances and provides answers to more “what if” questions. This gives the business owner the ability to predict cashflow problems and the time needed to avoid such problems.

Having an eye on the overall well-being of your project(s) with this type of forecast contributes to the successful running of a business. This is especially true if the CFO has a rigorous system in place to track expenses on a monthly basis and to project future expenses for the months ahead.

Pay attention to your expenses

Calvin Harris Jr. said “Many companies simply don’t pay enough attention to how much they pay for certain expenses. Business owners see the money coming in, but don’t realize just how much goes right back out the door.”

Resolving your cashflow shortages before they happen is important, as is keeping a close eye on every purchase made in your project structure. You should make sure every staff member is well-versed in the reporting procedure for every purchase made so that nothing falls through the cracks. The project manager should also be instructed to process a change order as soon as they come in because the proceeds will have a positive impact on your cashflow.

Resolving your cashflow shortages before they happen is important, as is keeping a close eye on every purchase made in your project structure. You should make sure every staff member is well-versed in the reporting procedure for every purchase made so that nothing falls through the cracks. The project manager should also be instructed to process a change order as soon as they come in because the proceeds will have a positive impact on your cashflow.

Credit sales

If you increase your sales it would appear that your cashflow increases as well. If large portions of your sales are made on credit, when sales increase -> your accounts receivable will increase, not your cash. Meanwhile, inventory is depleted and must be replaced. Because receivables will usually not be collected until 30 days after sales, a substantial increase in sales can quickly deplete your firm’s cash reserves.

Target consistent employee utilization

You have a higher likelihood of getting great quality results in your projects from re-using reliable employees from similar past projects or by employing them on a permanent basis. In doing this, you are minimizing the odds of accidents and project setbacks and increasing the chances of repeat business. These employees already know your procedures and it makes communication flow more comfortable. They also understand the role they play within the team and in keeping their part of the process functioning well, which helps the overall project to be completed efficiently.

Train your project manager on cashflow management

Cashflow provides an idea about your company’s real financial well-being. For example, in construction, 85% of cash comes from project work in progress, which means cashflow performance depends on the project manager’s cashflow management.

The average time it takes to get paid in construction is between 60 and 90 days. Strongly consider setting a realistic goal to reduce that number to 50 days. You can do this by offering payment incentives, writing clear terms, checking credit reports prior to making any deals, and restructuring terms with non-payers.

Send automated invoices immediately. If you want to maximize cashflow potential, send invoices ahead of time.

Make sure your billing, collections, and payables systems are operating efficiently. Setting a debit order date is a good way of ensuring you get paid.

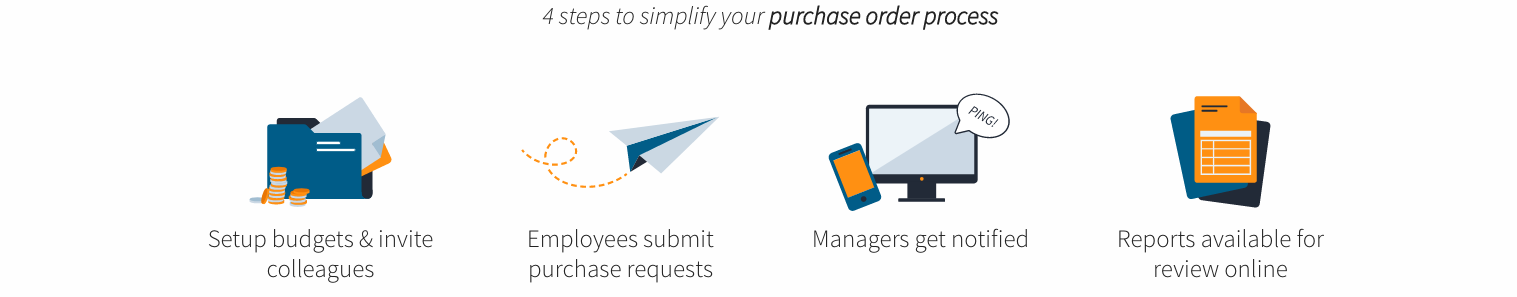

Using a smart spend management app

With the Procurementexpress.com purchase order management app all purchases are run through a set approval routing process, whereby managers who make the decisions, can approve all purchases with the click of a button.

We save you time with same day company-wide implementation. No training is required so all your departments can spend responsibly. We have an award winning customer success team available 24 hours a day. Ruberstamp.io is adaptable with tailored reports and a customizable Pdfs.

Successful trading means making the right decisions. An experienced lead cost controller will know the significance of progress and its overall effect on the project. Taking a serious interest in the spend rate is a given.

How do you ensure that your cashflow is managed correctly?