While we tend to focus most on POs and procurement strategy, we thought it would be a smart idea to highlight a related issue with some overlap and a similar set of benefits: How to manage Expenses.

According to a JP Morgan study, travel and entertainment expenses are often one of the most significant sources of spend, only behind labor and benefits.

As a procurement pro, you’re probably used to looking at areas where costs can come down, and expenses are a good target for uncovering places where you can save some cash.

That said, it can be difficult for companies to establish a clear cut policy when it comes to expense management.

[content_upgrade cu_id=”4417″]Benefits of a Sound Expense Management System–Download the free list to see what they are[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]

List Out Your Expense Categories

The first thing you’ll want to do when developing an expense management policy is to define the spend categories you’d like to put in place.

Typical expense categories are:

- Business meals

- Expenses associated with entertaining clients

- Gas mileage

- Lodging

- Airfare

- Office expenses

- Certain vendor expenses

Once you come up with a list of categories, you’ll then need to decide what kind of rules apply to each one.

Set Approval Flows

Many companies don’t document their approval processes. Instead, employees ask managers for approvals or reimbursements, without any formal system in place.

However, it’s smart to approach expenses the same way you would a PO process. You’ll need to decide who approves funds for specific categories, and what limits determine whether an additional approver is required for the “go-ahead.”

Approval routes depend on hierarchy, as well as department or category and typically include two to four approvers.

We recommend keeping this number to a minimum. While we get that you’d like to implement tight controls as a precaution, it’s frustrating to wait around for approvals or send multiple reminders about a request for funds. Instead, it makes more sense to use technology to provide an audit trail.

Before you start doling out company credit cards, you’ll need to connect with all of the key stakeholders in your organization from finance to accounting to the C suite.

From there, you’ll need to come up with an expense policy. What kind of spending limits will you put in place? How many approval tiers will you put in place?

In ProcurementExpress.com, you can easily set spending limits by employee. So, if you’re processing requests through our portal, you can automatically reject any order requests above a certain limit.

Much like materials procurement, expense management is all about establishing a sense of balance. It’s frustrating for employees if they feel that they are being monitored too closely, but you don’t want to give them free rein, either.

What Kind of Payment Method Will You Use?

The next thing you’ll want to address is how to pay for items. Will you use cash or card?

There are certainly some pros and cons associated with each method, and you may decide that some categories require a different approach.

Pre-paid cards are a reliable solution for business travel, but they might not cut it if you’re placing large order with a vendor.

Here are a few common ways that organizations track spending and when it makes sense to use these methods:

Pre-Approved Cards

This solution is gaining some traction across all kinds of industries and is especially useful if you’re working with salespeople or remote employees who purchase items on the road.

This way, you can preload cards in advance of a business trip, while still managing spend based on a pre-defined per diem and spending limit. For standard purchasing for things like office supplies or client lunches, admins can assign each employee a specific budget based on need, role, and other parameters.

Reimbursements

Reimbursements are essentially the old way of tracking expenses. For employees on the go, it means keeping track of paper receipts, which is likely something they don’t do much in their day-to-day life. That said, there are countless apps on the market these days, like Xero Expense, Zoho Expense, and others, which digitize the process.

Employees can snap a picture of their receipts and even automate sending expense reports to accounting. Reimbursement works well if an employee picks up some small items or pays for their meals during a business trip.

It’s not a great idea for handling large transactions, as you’re essentially borrowing large sums of money from your employees, which they might not be able to part with, even if temporarily.

Credit Cards

Credit cards are another old standby when it comes to managing internal spend. The challenge with these is, while you can set limits by role, you’re operating on a credit basis, so employees can easily overspend with minimal oversight.

Credit cards might be a suitable solution for some management roles, but they’re not a practical solution if you’re managing a larger organization or one that requires employees at every level to travel or make purchases regularly.

That said, using a corporate credit card can come with some cash-saving benefits. Here are a few things that a credit card company might offer:

- Rebates or cash rewards. If your organization does a high volume of transactions, this can add up fast.

- Easy reporting. Most credit card companies keep track of all expenses, eliminating the need for employees to log expenses. Admins will likely have access to the corporate account anyway, but software integrations make this process even easier.

- Auto-fill settings. Our software now allows companies to draft purchase orders from credit card transactions. So, you’ll have all of the backup documentation recorded in ProcurementExpress.com, as well as in QuickBooks, if you’ve synced the two accounts (recommended).

Digital Record-Keeping

We’ve stressed this many times when talking about purchase orders and vendor records, but digitizing paper processes protects against human error, ensures everything stays organized and saves a whole lot of time. The same is true with expense reports.

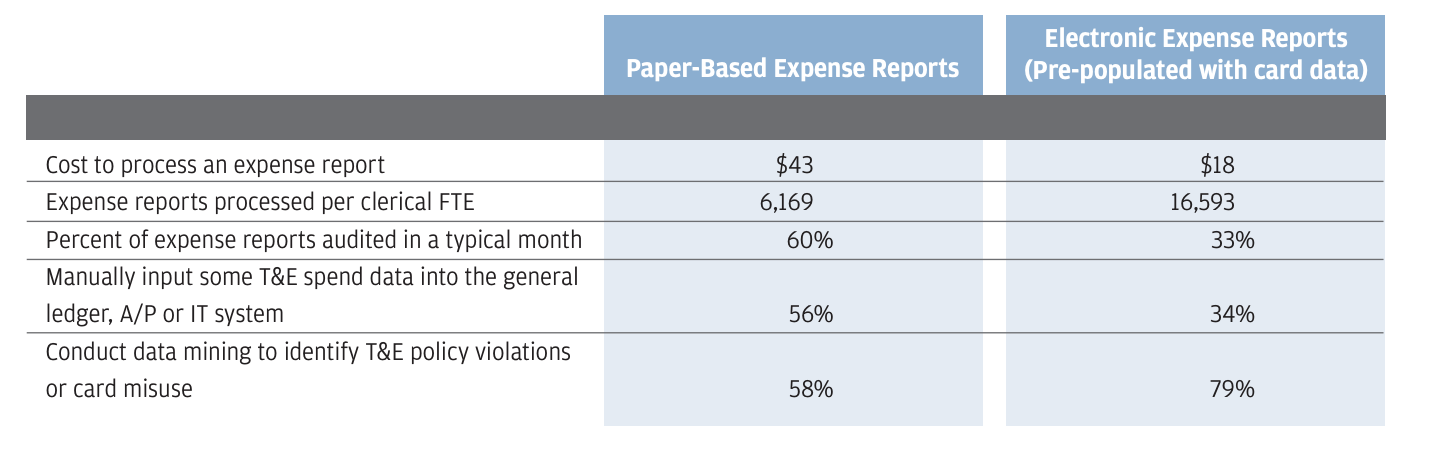

Use digital solutions so that you can process expenses faster and reduce costs linked to tedious data entry tasks. This chart (courtesy of JP Morgan) highlights just how much you can save by switching from paper expense reporting to electronic reporting.

[bctt tweet=”Digitizing paper processes protects against human error, ensures everything stays organized and saves a whole lot of time. The same is true with expense reports” username=”procurementexpr”]

The other benefit of a digital record-keeping system is that it brings all data into one central location, where all relevant stakeholders can see where spending is coming from and take action if needed.

Additionally, when you have digital records of everything from meals to travel to vendor transactions, you don’t have to scramble to find all of these items when tax season rolls around.

Manage Expenses and Reduce Fraud

Fraud is a result of an imperfect expense management process.

Bad actors learn how to exploit a disorganized system and will take advantage of the lack of control—even if it’s a matter of exaggerating mileage or a free meal here and there—this stuff adds up.

As such, it’s essential to make sure that everyone understands the policy. Internal controls should define what compliance looks like, as well as accountability. As is the case when defining a procurement strategy, expense management should be digitized and documented in an accessible, cloud-based system.

Wrapping Up

It’s not just procurement’s job to reduce internal spending; employee expenses require a strategic approach, too.

Expense management is all about establishing visibility and stopping any financial leaks before they get out of hand, whether it’s due to a vendor pricing problem or a lack of control over travel expenses. You need to know where all transactions are coming from to reduce overspending, fraud, and inaccurate or inefficient budgets.

ProcurementExpress.com can help you manage internal spending, too. Sign up for a trial and we will give you a tour of our built-in features and the integrations that power up your expense management game.

[content_upgrade cu_id=”4417″]Benefits of a Sound Expense Management System–Click here to receive your free list.[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]