No one wants to believe their trusted employees would steal from them, yet it happens all the time. People create fictitious vendors, inflate their salaries, and sometimes just take things without asking.

According to international insurance firm Hiscox, 85% of embezzlement cases were committed by someone in a management position or higher.

Meaning, these fraudsters are typically the employees you trust with your bank accounts, inventory, and sensitive information.

Below, we’ll discuss what companies need to know about embezzlement and how they can prevent it from happening in the first place.

Grab our free chapter on embezzlement in the workplace here for a deeper dive into internal theft.

Before we look at some of the ways that companies can identify and prevent embezzlement from happening to them, we need to quickly define what embezzlement actually is.

Embezzlement is a specific type of fraud that can be very difficult to prove. For general fraud to cross into embezzlement territory, it needs to meet the following criteria:

- There must be a professional connection between the embezzler and the targeted victim. In most cases, this would be an employee-employer relationship.

- The alleged embezzler must have taken assets or funds by taking advantage of that professional relationship. In other words, an employee can gain access to a system because of their status–they have access to finances or information that enabled them to steal from the employer.

- The alleged embezzler must have formally taken ownership of the stolen assets, goods, or funds in question, or deliberately transferred ownership to someone else.

- The person accused of embezzling must have intentionally taken something from their employer. While this seems obvious, it can be something of a murky area. In some cases, the alleged embezzler may not be aware that they’ve done something wrong, particularly if there’s already a culture of embezzlement at this particular company.

Now that we’ve defined embezzlement, what kind of activity actually qualifies as embezzlement?

- Payroll and Overtime Theft—Payroll fraud is one of the most common types of embezzlement and involves a payroll administrator inflating their own salary or someone else’s. In some cases, employees have added fake employees to the payroll, linking the deposits to a second bank account of their own. On a lesser note, employees who are hourly workers may abuse the system by claiming they’ve worked more hours than they really did, or commission-based workers may exaggerate the amount sold.

- Stock or Property Theft—In this case, an employee might just steal inventory or company property with no intention of returning it. This is more common in industries like retail where employees may walk off with inventory if there aren’t proper security measures in place.

- Cash Skimming—One of the more common forms of embezzlement, cash skimming is when an employee with access to funds either takes a small amount of cash themselves or siphons off a percentage of funds for themselves.

- Data Theft—In this case, the employee intercepts customer or company credit card information, or gets customers to make payments to a separate bank account by doctoring the information listed on an invoice.

Impact Embezzlement Has on an Organization

There’s no doubt that fraud can have a massive impact on an organization, most notably in terms of financial losses.

What you don’t think about as much is the ripple effect on internal crime. Embezzlement can erode company culture and morale, harm your company’s reputation, and increase the costs of external audits.

How to Spot Embezzlement in the Workplace

Embezzlement is one of those terms that has a specific association: the white collar criminal being indicted after stealing millions. There may or may not be off-shore accounts in the mix.

The reality is that embezzlement is far more common than you think. It happens at companies of all sizes and can be difficult to spot.

According to the Hiscox survey mentioned above, the average embezzler is someone who has worked at their company for about eight years and again, is a trusted member of the management team.

Further, the survey also noted that around a third of embezzlers worked in the accounting or finance department—staff that typically has access to insider knowledge—and nearly 20% engaged in some form of billing fraud.

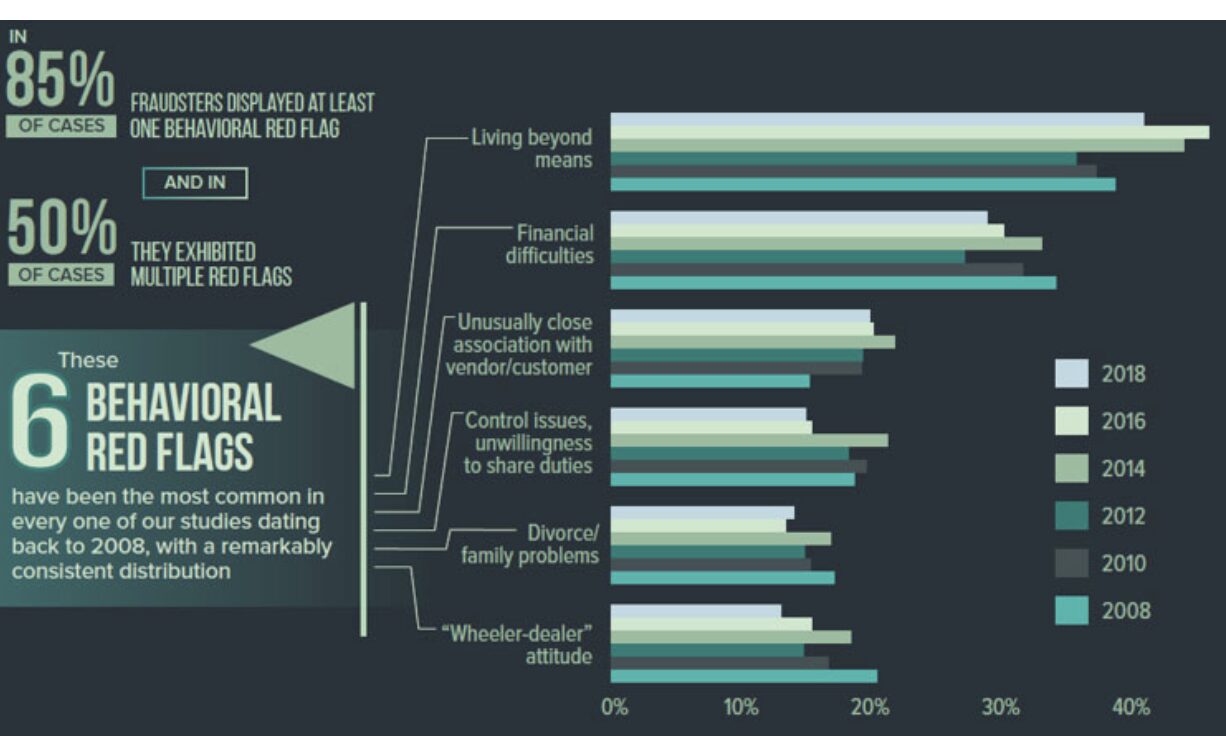

According to a report from the Association of Certified Fraud Examiners, most employees who embezzle funds exhibit some tell-tale signs. Make sure you keep an eye out for any of the following warning signs:

- The employee appears to be making a lot of purchases that their income likely can’t support—new cars, vacations, etc.

- The employee refuses to take time off, as theft may be detected by their replacement while they are away.

- The employee has unusually close relationships with vendors or customers.

- There are signs of family or relationship troubles.

- The employee has a new-found dedication to working from home, after hours, or working late.

- There are signs of alcohol and/or drug abuse.

- There is evidence of gambling or financial troubles.

Let’s Talk Preventative Measures

Most businesses don’t have enough staff on hand to implement a 100% embezzlement-proof solution. But it’s worth pointing out that implementing a tech-driven approach to ordering, fraud monitoring, and record-keeping takes care of a good portion of your embezzlement prevention plan.

Here are some things you can do to minimize the risk of fraud and make it easier to detect any signs that something is a bit “off.”

Run Pre-Employment Checks

A pre-employment check will reveal a great deal about potential employees with any criminal history. While it won’t cover all of your bases, making background checks part of your hiring process will prevent dishonest workers from slipping through the cracks.

Document All Transactions

Part of that includes setting a firm expense-tracking policy and using purchase orders for everything you buy. Our first recommendation here is to digitize all purchasing. A system like ProcurementExpress.com allows you to process and store all purchasing activity in one central location, recording any changes made to documents.

We also recommend separating the ordering, payment, and receipt of goods and services, so that different individuals are in charge of handling each of these functions.

Restrictions and Authorizations

Protect your finances by requiring dual authorizations for bank transfers and taking advantage of user restrictions inside your accounting software.

This includes setting approval workflows for processing purchase orders, sticking to a list of approved suppliers, and routing high-value orders to a senior approver as an added precaution.

Implement an Internal Review System

No one employee should have full control over any one system. To prevent this from happening, implement a policy that does the following:

- Bank reconciliations should be reviewed by someone outside of accounts payable.

- Inventory counting should be done by someone who is not also responsible for ordering or receiving inventory.

- Credit card statements should be reviewed and reconciled by someone who does not have a company credit card.

- Staff should be cross-trained staff so that they can regularly rotate job duties.

Run Regular Audits

Most accounting software will come with an audit trail built into the platform.

ProcurementExpress.com has this feature, as do many of the leading SaaS tools like QuickBooks.

By simply digitizing all financial activity from purchasing and invoicing to processing expenses, business owners can quickly scan their organization’s accounting system for unusual activity.

You may also want to conduct unannounced audits periodically, or request invoices and supporting records without any lead time. These surprise checks can help nip any suspicious activity in the bud.

And finally, you’ll want to run regular audits through an independent, third-party professional to check that nothing has slipped through the cracks.

As you can see, many of these activities center around the idea of getting organized and following best practices.

Wrapping Up

We get it: some business owners are hesitant to implement controls when it comes to internal fraud protection. Some employees might take this as a sign that they are being watched, making them feel like they aren’t trusted.

To that, we say, transparency is the best policy. Be upfront about the internal checks and balances that occur within your company–most honest employees won’t have any issues with this.

Evaluate your current internal controls and make sure both you and your staff know which red flags to watch for; to help them with this effort, create a policy for monitoring and implementing proper controls.

In the end, however, you need to protect your business against bad actors that could hurt your reputation and do some serious damage to your bottom line. ProcurementExpress.com is one tool that can help business owners simplify their purchasing process and gain more control over what is being purchased and from whom. Learn more by booking a demo.

Want to learn more about embezzlement? Download our chapter on the topic to take a deeper dive.

Get Top Rated Purchasing Software & Replace The Purchasing Book.