According to a US bank survey 82% of business failures are due to poor cash management.

Every time you spend the company’s money, you could be edging towards becoming a part of that statistic. The secret to spending money effectively is actually a lot more counter-intuitive than is sounds.

In this article, we will run through some “spending hygiene”, that your entire team should be aware of in order to qualify for handing over your hard won turnover.

How will this benefit your company?

Businesses are complex beasts. There are many spending levers you can pull, each with wildly varying effects. A good place to start would be to define KPI’s for your business and deciding how the spend will affect those KPI’s.

If you do not have KPI’s set up, here are five thought experiments you can run on your spend before you decide to proceed;

- Will this spend generate more prospective customers?

- Will this spend help more of those prospects convert?

- Will it help customers increase the price they pay you?

- Will it cause customers to buy more frequently?

- Will it improve our margin?

How else could you get that benefit?

Before committing the spend, considering how the business could achieve a similar outcome is worth thinking about. Often times this is not simply about comparing prices. There are no certainties in business and spending decisions need a probabilistic approach to evaluating them. Other strategies for achieving the same business outcome will have varying prices and chances for success. For substantial spend, its worth `brainstorming’ other ways of driving the business forward in the same way.

| Option | Outcome | Chance of success | Cost |

| Option 1 | More leads | 80% | $20k |

| Option 1 | More leads | 50% | $3k |

| Option 1 | More leads | 10% | $5k |

| Option 1 | More leads | 20% | $1k |

Of course these “chances of success” are nothing but wild assed guesses(tm), but working through the exercise can get your creative juices flowing.

How is it funded?

“The bank account” might seem like an obvious answer. But it is useful to think about how this money will be sourced. Sometimes budgets are allocated according to operating cash flow, but other times the money comes from investment income.

The psychology behind how we spend from these sources differ.

Managing Partner at Magma Partners, Nathan Lustig observed that how hard the company had to work for their money could directly impact how easily company owners decide how to spend it.

“Government funded startup companies are far laxer when it comes to managing money when compared to those that source their money privately”, says Nate.

What impact would making this spend have on the other needs of the business?

Will spending now mean there will not be enough money to cover other vital expenses later on?

A budgeting process will help to ring-fence funds, to ensure that cash flow issues do not arise. Failing to manage cash flow is the number one reason failed companies cite for their bankruptcy. That does not necessarily mean they ‘ran out of money’. It can often mean that they misallocated funds on non-vital areas of the business and had none left for the vital parts.

Funding spend from “operational cash flow” is also not straightforward. A common mistake is to reason that if an item costs X, “we only need to make 2x” to cover the cost. In fact, this is wrong.

All businesses operate at a margin. Depending on the sector, it can vary widely from 70% to 1%. ‘Covering’ the cost of expenditure needs to be done with actual profit, not turnover. So, for example, a company that operates at a 50% margin needs to double the price of an expenditure just to cover the cost. Most businesses operate at a much lower margin. A 20% margin means that the company needs to sell 5 times cost price of an item to cover the cost.

| Cost | Margin | Turnover needed to break even |

| $100 | 50% | $200 |

| $100 | 25% | $400 |

| $100 | 5% | $2,000 |

Are you in the right mind to make this decision?

The HALT framework outlines a methodology for making better decisions, not just spending decisions. Standing for Hungry, Angry, Lonely or Sad (HALT) it runs through some situations where people are proven to make poor decisions. Often times, making a quick audit of your own mental state can tell you whether making this is the right time to make this decision. It’s probably also a good checklist to run through before you decide to divorce your wife or send that email to your ex-girlfriend, but that is another day’s work.

Is this decision audited?

“Everybody lies”, according to the TV doctor “House”. He is of course wrong. Only 70% of people lie (or at least cheat) according to real life doctors. Behavioral economist Dan Ariely ran a battery of tests designed to see if people would cheat for monetary gain. The experiment included over 40 thousand participants from all over the world. The results were surprisingly consistent across continents, belief systems (or lack thereof), gender and age. 7 out of ten times, when assured there was no chance of getting caught, people will cheat for monetary gain. In business, there are frequently “secondary gains” on offer when considering spending decisions. Vendors play on this and sometimes, out and out bribe employees to give them their custom. This may come in the form of a “free” gift or straight out cash.

Having a spending decision audited by someone else, either before or after the event, will dramatically cut this type of poor choice. Having small decisions double checked in this manner may seem petty. It’s worth remembering though that indeed almost everybody lies and we might as well face up to that fact. We’re human, so let’s work with that.

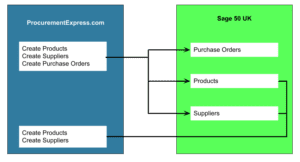

Our ProcurementExpress.com app, however, doesn’t lie and it’s a viable solution to your spend management…