A budget that is consistent with the proposal narrative justifies the charity budget. It is not only the key element of getting future funding but also a sign that you can manage expenses. Before donors approve your application, they would check if you have a spend management plan in place. And if this plan is congenial to donors long-term goals.

Example

On a paper published by DailyMaverick, an expert pointed out that during Apartheid years, foreign donors channeled funds in a clandestine manner to NGOs aiming to eradicate apartheid. This could have contributed to a lack of transparency deeply rooted in charities today. This brings us to the Idasa saga. In 2013 Idasa (Institute for Democracy in Africa.) closed its doors owing to lack of funding. The High Court papers revealed that Idasa had accumulated losses amounting to R26 million. Donors continued to fund this NGO without having a clue of how the organization managed expenses or what the budget looked like.

This is why it’s important that NGOs make their expenses transparent. You can make your finances transparent by employing efficient software. And the best place to start is with your purchases. Get a purchase order software that can help your organization to spend within budget.

Let’s look at these five important budget expenses.

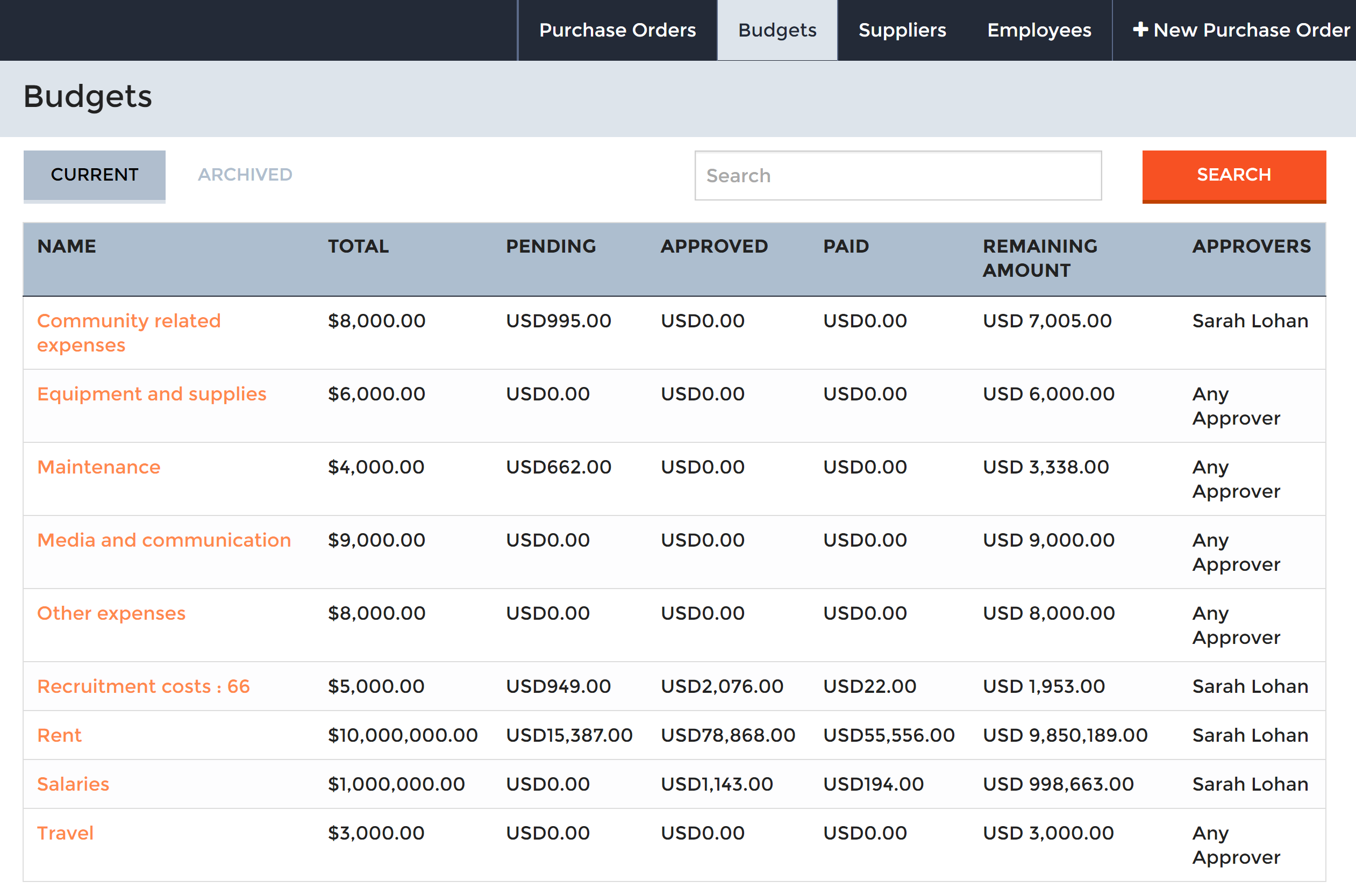

1.Salaries

The first item scrutinized closely by potential donors are salaries. While setting salary scales is difficult, it’s important that set salaries are reasonable. You might consider using indicators like your current economic conditions as your barometer for setting reasonable salaries.

Just make sure that you have to stick to budgeted salaries. Remember that a minimum of 10% to 20% of the budget should go towards paying salaries, the rest is for other program expenses.

2.Rent

Fixed costs like rent can give you a headache. If you feel that the rent you’re currently paying is beyond your means, there’s an option of looking for alternative office space.

Hidden costs like electricity have a way of lending themselves well in rent. This happens when your rent doesn’t include electricity. In countries where demand for electricity exceeds supply, it becomes difficult to budget for electricity rates.

There’s also rent for office equipment like photocopy machines. Some companies find renting machines cheaper than buying. You will need to weigh your options very well beforehand. Just ensure that your proposal reflects that you’re striving to be frugal.

3.Fundraising costs

Donors find it hard to accept that nonprofits use funds to raise funds. Your proposal should reflect fundraising costs well. While donors understand that you can’t raise extra funds without using funds, indicate this on your proposal. If you exceed your fundraising goals, what will be done with the surplus? This should also be clearly stated in your proposal.

4.Community-Related costs

A large part of your surplus should surely go towards addressing your community projects. Planning for these costs may not be an easy task as community projects are not predictable.

The best to budget for community-related costs would be to base your estimates on the previous year’s expenses.

5.Purchases (Cost of activities.)

Purchases are done by any nonprofit from time to time. We can’t treat purchases as a cost of sales account because NGOs do not operate to make a profit.

https://www.humentum.org/free-resources/top-tips/tt16-procurement-process

According to Humentum, a good procurement process ensures that:

- the process presents little fraud risks,

- and the process is fast enough to meet program needs.

If you’d like more info about Procurementexpress.com, please contact us: [email protected]

Leave a comment.